The rise of Real World Asset (RWA) tokenization is shaking up the way we invest. Traditional finance and decentralized finance (DeFi) are merging into a marvelous mixture. Now you can invest in a variety of real-world assets—like real estate, commodities, and bonds—without leaving crypto space. This shift makes it easier to tap into assets that were once hard to access due to jurisdictional and budget issues. As this RWA landscape grows, it’s opening new doors for smarter, more flexible investment opportunities.

What Are Real World Assets, and Why Should You Care?

Real World Assets (RWA) refer to traditional financial assets that have been tokenized on the blockchain. Essentially, this means taking real-world assets—like real estate, bonds, or commodities—and converting them into tokens that can be easily traded and used in decentralized financial (DeFi) applications. Tokenization simplifies the transfer of value, lowers costs, and streamlines how financial transactions are managed.

While the exact size of the RWA market is tough to calculate since the space is still new and evolving, we can still estimate. To get a clearer picture, we should exclude the market caps of governance tokens tied to RWA-related protocols and their total value locked (TVL), as these are not tokenized real-world assets. However, stablecoins should definitely be included. Currently, the RWA market is valued at over $185 billion, with stablecoins making up around 95% of that.

Within the RWA space, we can identify several key categories. Each offers a unique investment opportunity, and we'll explore them in the upcoming chapters:

- Stablecoins: Cryptocurrencies backed or collateralized by fiat currencies like the US dollar.

- Private Credit: Tokenized loans and credit instruments.

- Treasury Bonds: Tokenized government debt.

- Commodities: Physical goods like gold or agricultural products represented as tokens.

- Real Estate: Property ownership divided into tokenized shares.

- Stocks: Equity in companies issued in the form of tokens.

Stablecoins: Bridging the Gap Between Crypto and the Real World

Stablecoins are not only the first but also one of the most vital Real World Assets (RWA), serving as a bridge between traditional finance and the crypto world. In fact, stablecoins act as the financial fuel for the entire DeFi ecosystem. While technically any asset pegged 1:1 to something real—like gold—could be considered a stablecoin, we'll focus here on fiat-pegged stablecoins. These are digital currencies tied to government-issued currencies like the US dollar. Stablecoins provide a stable measure of value and make it easy for users to transition between crypto and traditional finance. Ethereum and TRON are the leading networks for stablecoin issuance, accounting for more than 86% of the total stablecoin market, which estimates more than $170 billion of capitalization.

There are two main types of stablecoins: centralized and overcollateralized. Centralized stablecoins, like USDT (Tether) and USDC (Circle), are backed by fiat reserves held by companies. These companies hold an equivalent amount of fiat currency or government and commercial securities to maintain the 1:1 peg. At the time of writing, USDT, the most prominent example, has a capitalization of $118 billion, followed by USDC at $35 billion. Overcollateralized stablecoins, like DAI, operate differently. Instead of fiat, they are backed by other crypto assets, often holding more in reserves than the value of the tokens issued. This extra collateral helps maintain stability during price fluctuations in the crypto market.

Commodities: Tokenizing Gold, Grain, and More

Tokenized commodities are still an emerging market, with a relatively small market cap of around $1 billion, but they offer significant potential. Precious metals like gold, energy resources such as oil, and agricultural products like wheat and rice can all be tokenized and traded on the blockchain. These "commodity stablecoins" are pegged to real-world resources, giving you access to their value without the complexities of traditional commodity markets.

Several examples highlight the growing diversity in this space. Tether Gold (XAUT) and Paxos Gold (PAXG) are two well-known tokens backed by physical gold that give investors a way to own gold without dealing with storage. OilCoin (OIL) offers exposure to oil reserves, though it has struggled with audits and adoption. Another interesting player is LandX, which focuses on agricultural commodities. By tokenizing crops like wheat, rice, and soy, LandX gives investors a chance to own a share of real-world farmland production. This approach could reshape agriculture investing, offering more yield-generating opportunities in a market that has traditionally been conservative and difficult for the average investor to access.

Private Credit: Unlocking Liquidity Through Tokenization

Private credit refers to loans provided by non-bank entities, like investment funds and specialty finance companies. By tokenizing traditional debt instruments—such as loans and mortgages—and integrating them with smart contracts, we enable these assets to function automatically on the blockchain. The global private credit market is valued at $1.5 trillion, yet only about $9 billion of that has been tokenized so far, highlighting the room for growth.

Tokenized private credit offers fractional ownership of loans, allowing smaller investors to get involved in a market that was once reserved for large institutions. A notable example is Goldfinch, a decentralized lending platform that provided over $100 million in loans to fintechs and credit funds in emerging markets during 2022. However, it faced challenges with defaults as many borrowers struggled to repay unsecured loans. This forced Goldfinch to pivot its business model, turning into a private credit software provider. Thus, the key challenge remains: ensuring that borrowers repay their loans in a decentralized system.

Bonds: Tokenizing Fixed Income

Bonds, as fixed-income instruments, have long served as the backbone of traditional finance. They provide investors with a stable, low-risk way to earn returns, whether through government or corporate debt. The global bond market is enormous, with a staggering capitalization of over $133 trillion, making it one of the most vital financial markets. However, despite its size, only a small fraction—around $2 billion—has made the leap into the world of tokenization.

The tokenized bond market is largely driven by companies issuing stablecoins backed by Treasury bonds. Ondo Finance, for instance, has launched USDY, a stablecoin secured by short-term U.S. Treasury bonds, providing both price stability and a yield from bond interest. Similarly, the Mountain Protocol's USDM stablecoin, based on Ethereum, is backed by U.S. Treasury bonds and offers a passive income of around 5% per year.

Tokenized Stocks: A New Way to Own Shares

Tokenized stocks brings a fresh perspective to equity ownership. The real value lies not only in the transparency and efficiency of tokenization but also in its ability to create equity derivatives and use them as collateral in decentralized finance (DeFi). Despite its potential, the market is still in its early stages, with tokenized shares having a total estimated capitalization of less than $10 million.

Leading the charge are companies like Backed Assets, which offers tokenized stocks trading on Coinbase, alongside platforms such as Swarm Markets and Dinari. Institutional investors are also stepping in. In October 2023, JPMorgan introduced its Tokenized Collateral Network (TCN), a service designed to convert traditional shares into digital assets. HSBC, the UK’s largest bank, plans to launch a service allowing customers to hold tokenized securities in 2024.

Real Estate: The Sleeping Giant of Tokenization

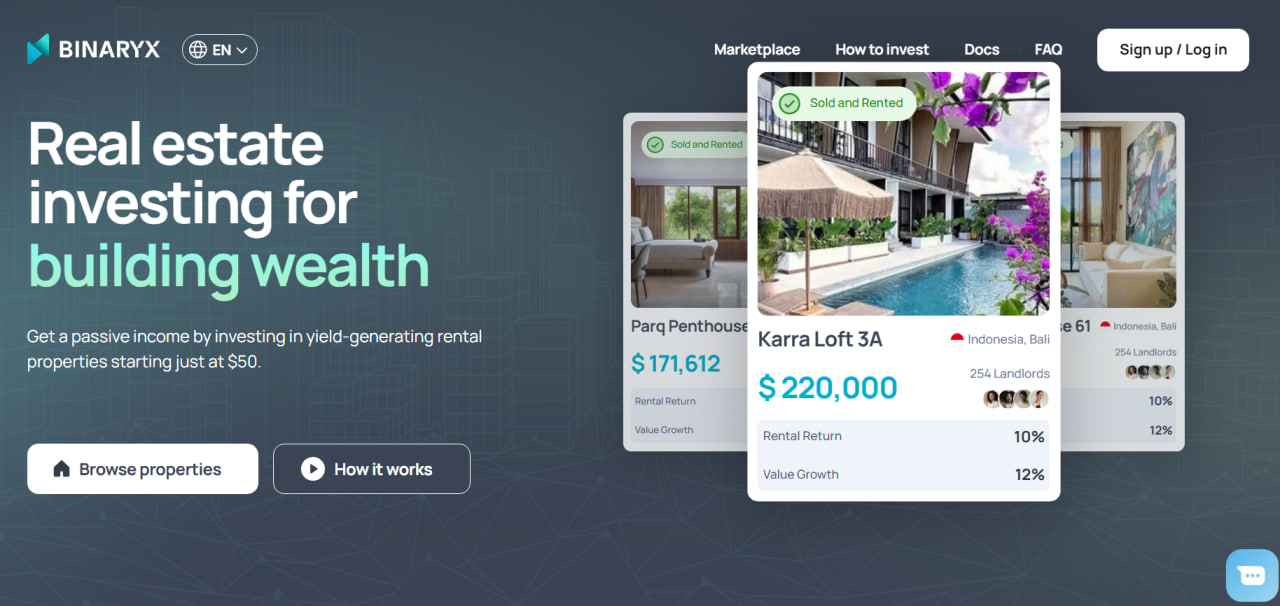

Tokenized real estate brings a new level of accessibility to property investment, allowing investors to own fractions of a property. In this process, property ownership is divided into tokens, each representing a portion of the underlying asset. These tokens can be bought, sold, and traded on blockchain platforms, similar to stocks, making real estate investments more liquid than ever. This process democratizes property ownership and gives retail investors the opportunity to participate in high-value real estate projects with minimal capital. Leading platforms in this space include RealT, Binaryx, and Lofty.

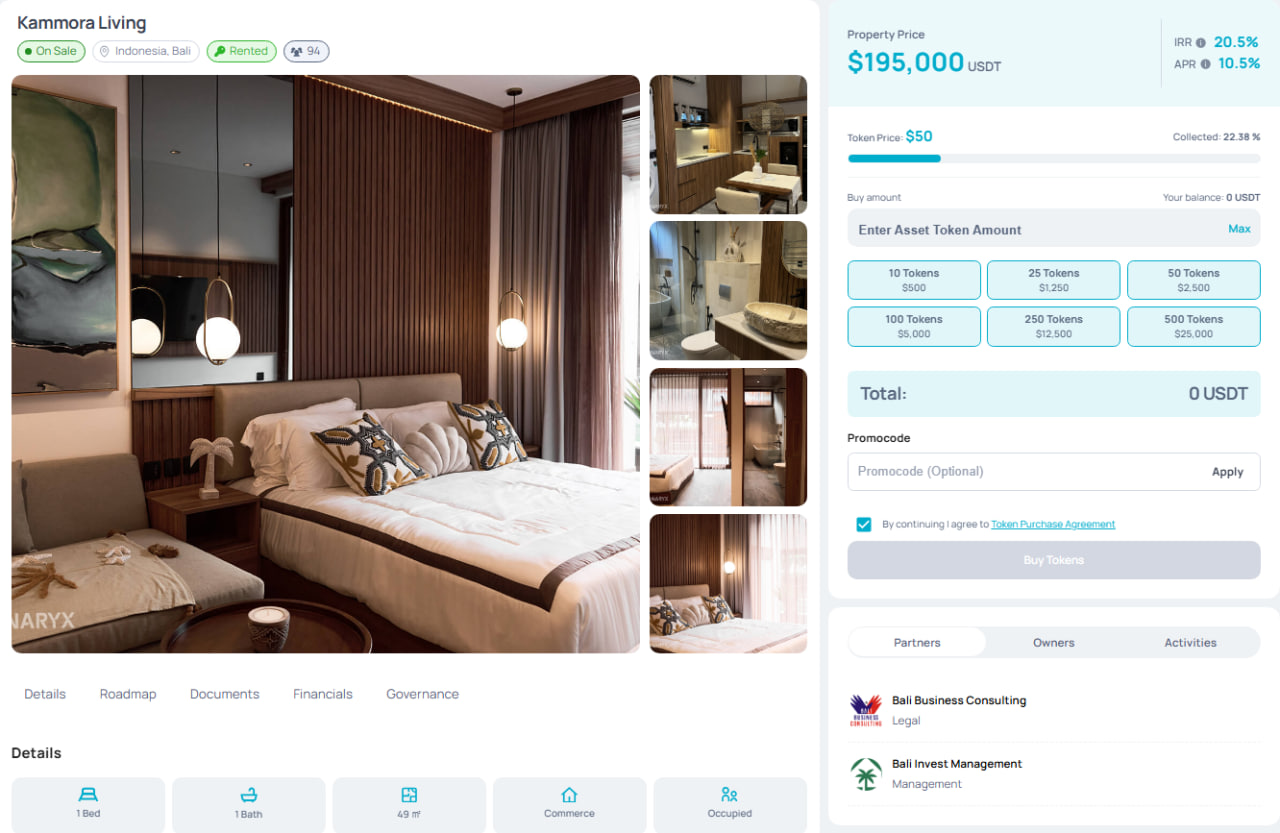

Let’s take a look at how tokenization works on the Binaryx platform. For example, consider a $195,000 Kammora Living villa in Bali. Once the right property is identified, Binaryx establishes an LLC to hold the legal title. The LLC is then divided into fractions, and these fractions are issued as tokens. In the case of Kammora Living, we’ve issued 3,900 tokens, each worth $50. These tokens represent fractional ownership and are managed by smart contracts that automate rental income distribution and simplify asset management. Investors can easily purchase these tokens on the Binaryx platform, earn proportional rental income, and later sell them on secondary markets. Check it out!

Leading Blockchains for RWA Tokenization

Ethereum, along with its Layer 2 solutions, leads in Real World Asset (RWA) tokenization, primarily because it’s the oldest, most trusted, and widely used smart contract platform. Its established infrastructure, security, and active developer community make it the go-to blockchain for tokenization projects, and it will likely maintain this dominance in the foreseeable future. While Ethereum remains the primary hub, other blockchains like TRON, Solana, and Avalanche keep trying their best.

Occasionally, corporations and banks attempt to create their own private blockchains, often with mixed success. For example, JPMorgan’s Quorum and IBM-backed Hyperledger Fabric have been launched for enterprise use, but they haven’t reached the same level of adoption as public blockchains. Ultimately, public chains like Ethereum are poised to remain the primary platforms for RWA tokenization, as they offer the decentralization, security, and global accessibility that private chains struggle to match.

Future of Real World Assets

The future of Real World Assets (RWAs) looks promising as the crypto industry matures and more traditional institutions begin to adopt blockchain technology. We’re already seeing the shift from hype to real-world synergy, where crypto assets are integrated with existing financial systems. This trend is only set to accelerate as tokenization opens up new opportunities for greater liquidity, transparency, and access to previously illiquid markets.

By 2030, estimates suggest that the market for tokenized assets could reach between $3.5 trillion in a bearish scenario and up to $10 trillion in a more optimistic outlook. As more traditional institutions enter the space, the demand for secure, decentralized platforms for RWA tokenization will rise. While challenges remain, the groundwork is being laid for a future where RWAs play a central role in both decentralized finance and traditional financial markets. Join this future with the Binaryx Platform – try out RWA in real estate!

Articles you may be interested in

.jpg)

.png)

.png)

.webp)