The 8 Best Countries for Crypto and RWA Tokenization: A 2025 Guide for Investors and Entrepreneurs

As the global economy increasingly adopts blockchain and the tokenization of real-world assets (RWAs), entrepreneurs and investors must make a critical decision about where to start or extend their crypto enterprises or where to legalize their crypto portfolios. This decision goes beyond mere tax considerations; it is about selecting locations with extensive legal frameworks, that support regulatory clarity and innovation.

From the U.S. and the EU to Singapore and the UAE, regulators worldwide are increasingly introducing laws to govern cryptocurrencies and tokenization. In this article, we examine the world's leading jurisdictions based on crypto-friendliness, market share in tokenization, institutional participation, and future growth potential. If you want to make smart decisions in 2025 and beyond—whether for starting a crypto startup or simply investing in crypto and tokenized RWA assets—you must know which countries are aiming to be the leaders in this field.

The United States

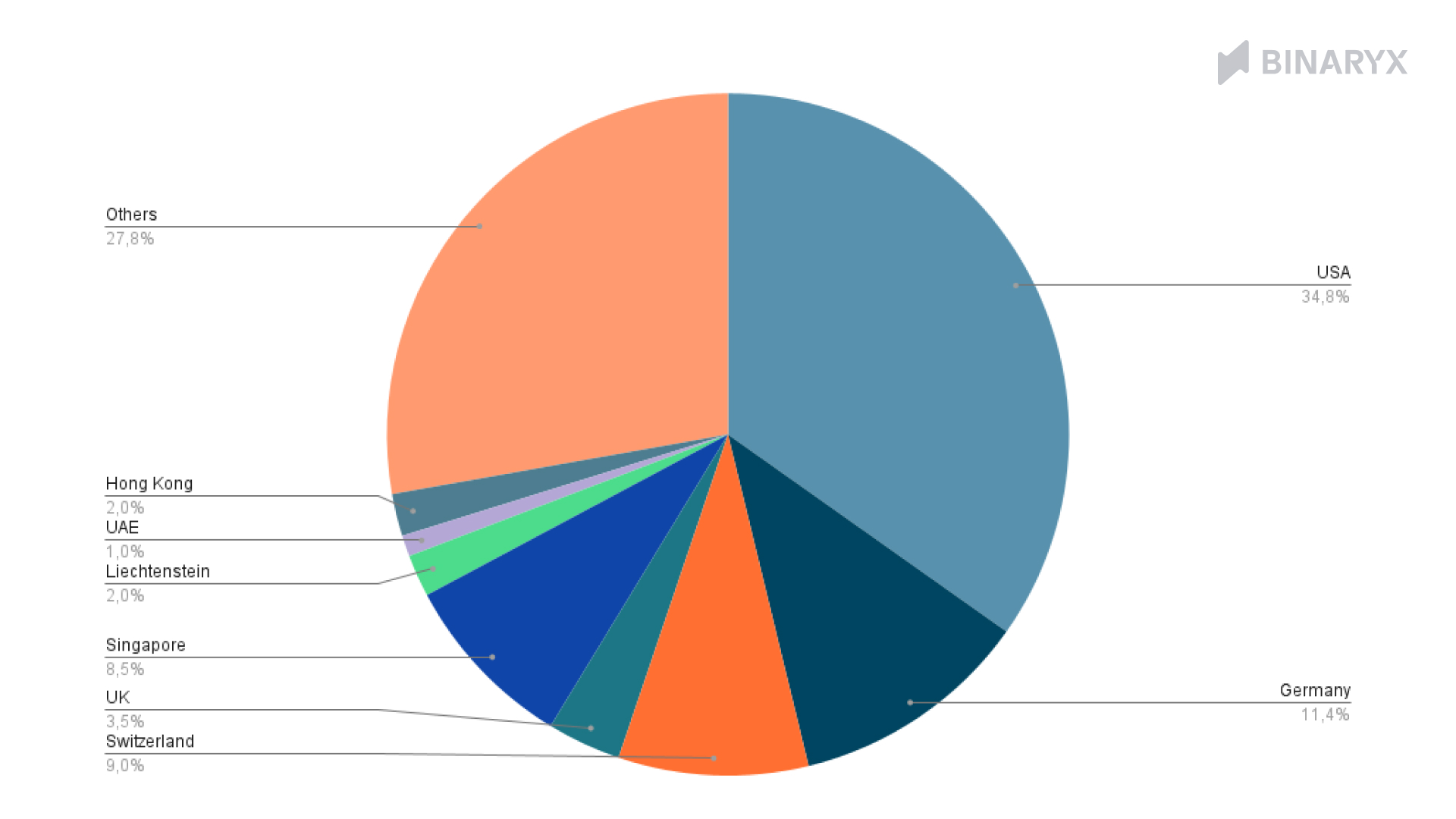

The U.S. holds a dominant position in the global asset tokenization market. By the end of 2023, the U.S. accounted for 34.8% of all cryptocurrency product launches, according to rwa.world. However, this dominance didn’t come easily. Regulatory hurdles long limited industry growth, with the approval of the Bitcoin ETF in early 2024 marking a breakthrough after over a decade of rejections and legal battles.

Following the ETF approval, key legislative initiatives began gaining momentum. One of the most significant was the bipartisan Lummis-Gillibrand Stablecoin Bill, which aims to establish clear rules for stablecoins, representing around 97% of tokenized assets. If passed, the bill could simplify the launch of new stablecoins and interactions between banks and the crypto industry.

Political changes could further accelerate regulatory progress. Donald Trump’s victory in the 2024 presidential election promises a more relaxed regulatory environment after his inauguration. His administration is expected to fast-track the development of a comprehensive regulatory framework for the crypto industry, addressing challenges such as the banking issues that crypto companies faced during the "Chokepoint 2.0" era.

Institutional players in the U.S. are actively driving tokenization, particularly in the treasury bond segment. Notable projects include BlackRock’s BUIDL fund and Franklin Templeton’s Benji initiative.

Germany

Germany is a leader in Europe’s tokenization market, holding about 11.4% of the regional share. The country has developed a clear legislative framework both at the national level and through support for the EU-wide Markets in Crypto-Assets Regulation (MiCA). The newly introduced KMAG law integrates MiCA requirements into local regulations, creating a predictable environment for businesses.

Tokenization in Germany remains largely experimental. In 2023, the state-owned bank KfW issued €20 million in tokenized bonds through a centralized depository. Major players like Deutsche Börse and Tradias actively incorporate blockchain into their financial products.

Switzerland

Thanks to its strict standards and flexible regulations, Switzerland controls 9% of the global tokenization market. The country places significant focus on issuing tokenized bonds.

In 2024, the canton of Basel issued bonds worth 105 million Swiss francs via the SIX Digital Exchange, while the city of Lugano issued two bonds of 100 million francs each. Switzerland’s "Crypto Valley" in Zug plays a major role, housing over 500 blockchain companies, including Polkadot, Bancor, and Backed Finance.

The United Kingdom

The U.K. accounts for about 3.5% of the global tokenization market. Its Financial Services and Markets Act (FSMA) regulatory sandbox enables experimentation with tokenized assets, including securities.

One standout initiative is the Regulated Liability Network (RLN), which explores programmable money and central bank digital currencies (CBDCs). Additionally, startups like Coadjute use tokenization to streamline real estate transactions, working closely with major property agencies.

Liechtenstein

Liechtenstein controls roughly 2% of the tokenization market. In 2020, the country introduced the Token and Trusted Technology Service Providers Act, which provides a comprehensive legal framework for tokenization. This law defines tokens as “containers” representing assets or rights and regulates their use, including anti-money laundering measures.

A unique feature of Liechtenstein’s framework is the role of the physical validator, which ensures that tokens accurately represent real-world assets. This clear regulation makes Liechtenstein an attractive hub for issuing tokenized securities.

Singapore

Singapore holds about 8.5% of the tokenization market and continues to strengthen its ecosystem through initiatives like Project Guardian, which explores tokenization in finance. The Monetary Authority of Singapore (MAS) leads with a progressive stance and clear regulatory policies.

While public tokenized bonds have yet to appear on the Singapore Exchange, MAS is working on a Global Layer 1 initiative to standardize blockchain platforms and create regulations for tokenized funds.

The United Arab Emirates

The UAE controls about 1% of the tokenization market, with regulations varying by the emirate. Dubai and Abu Dhabi lead the charge. Dubai, under the Virtual Assets Regulatory Authority (VARA), has created favorable conditions for crypto startups and exchanges. In 2022, it introduced its own virtual asset regulations, solidifying its position as a global innovation hub.

Abu Dhabi, on the other hand, takes a more conservative approach. It focuses on financial stability and attracts major investors through stringent rules.

Hong Kong

Despite holding a modest 2.5% share of the tokenization market, Hong Kong is rapidly building its presence. China appears to be using Hong Kong as a “sandbox” for testing crypto initiatives.

In April, Hong Kong approved its first Bitcoin and Ethereum ETFs and launched retail sales of tokenized gold. By positioning itself as China’s crypto capital, Hong Kong plays a unique role, but strict restrictions remain across mainland China.

Tips for Choosing Your Crypto Jurisdiction

The race to become the world's leading crypto and tokenization hub is far from over. The jurisdiction choice may be the most important decision any crypto entrepreneur or investor makes in the next few years. The only certain thing is that the countries that manage to find the sweet spot between freedom for innovation and protection for investors will be the ones to reap the most benefits from this game-changing market. Here are some practical considerations to look at:

- Talent Pool Availability: Access to blockchain developers, compliance specialists, and finance professionals with digital asset experience;

- Banking Relationships: How simple it is for cryptocurrency companies to form banking ties;

- Taxation Structure: Not just corporate tax rates, but also treatment of all financial assets, capital gains, and potential incentives;

- Ecosystem Maturity: The presence of investors, service providers, and complementary businesses;

- Perception on a Global Scale: The potential impact of a company's formation in a specific country on its reputation among users, partners, and investors.

To stay relevant and take advantage of opportunities in several countries, the most successful cryptocurrency ventures may use multi-jurisdictional tactics. The legislative environment will surely change as we get closer to 2025, with frontier markets maybe becoming new centers for tokenization innovation.

Afterword

This article represents just one chapter from the comprehensive "RWA Thesis 2025" report, which offers a deeper dive into the tokenization landscape, market projections, technological frameworks, and emerging opportunities across the entire RWA ecosystem. If you're interested in understanding how real-world assets are reshaping the global financial system, we encourage you to read the full report for a complete picture of this transformative movement.

Articles you may be interested in

.jpg)

.png)

.png)

.webp)