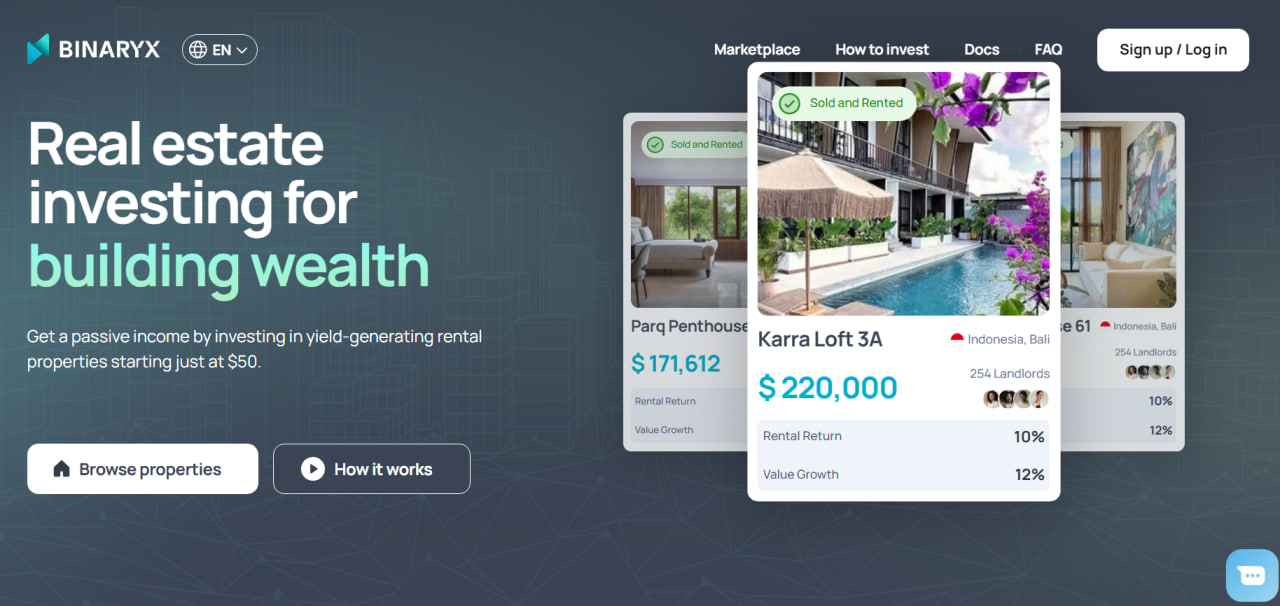

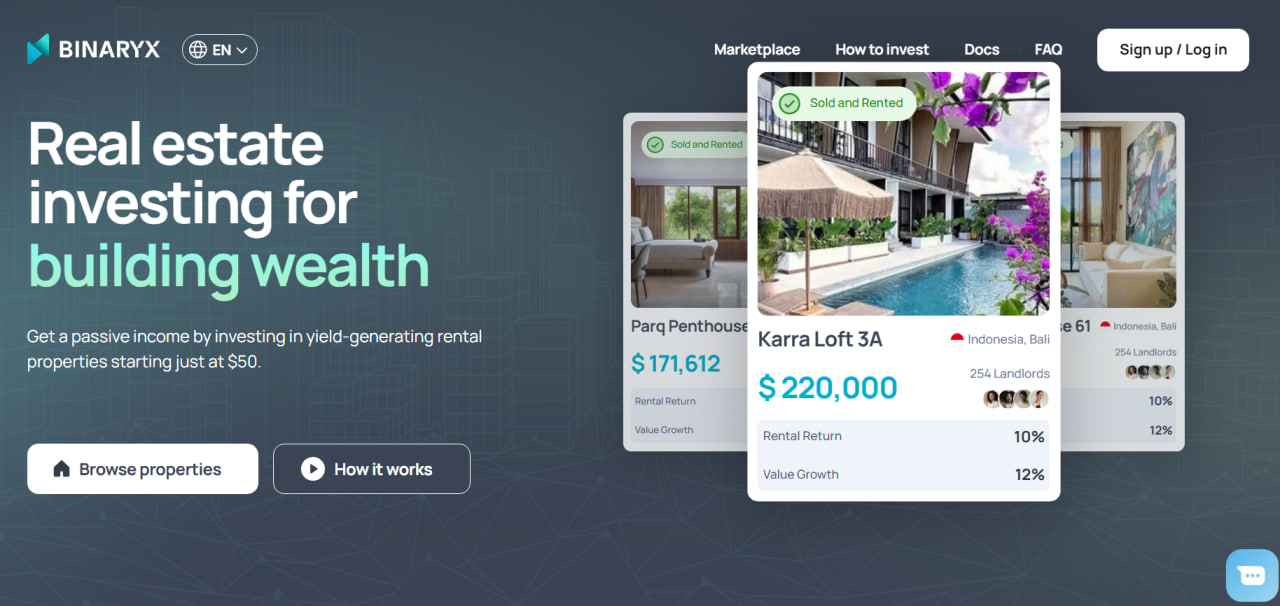

Is Real Estate Only for the Rich?

Think real estate is only for those with deep pockets? That’s the misconception keeping many from tapping into one of the most stable and rewarding investments out there. The truth is, you don’t need to be wealthy to start building wealth through real estate. There are plenty of ways to get started, even with a modest budget, and this article will show you how.

How Much Do You Really Need to Start?

In traditional real estate, “a little money” usually means tens of thousands of bucks. Depending on where you’re located, you might need at least $20,000 to $50,000 just for a down payment on a small property. And that’s before factoring in closing costs, taxes, and possible renovations. For many, this high barrier stops them before they even begin.

But times have changed. Today, you can start investing in real estate with as little as $50 through various digital platforms and financial instruments. REITs, real estate funds, crowdfunding, tokenization—all that fancy stuff—have flipped the script, letting investors own a piece of property without carrying the full financial burden. Now, your entry point to real estate isn’t just lower; it’s far more flexible.

Real Estate: A Smart Play, Even on a Tight Budget

Real estate isn’t just a number on a screen—it’s something you can touch, see, and own. A roof over your head, land beneath your feet. No matter how much capital you have, real estate offers stability that’s hard to beat. Unlike stocks or crypto, real estate is tied to a fundamental human need—housing. Everyone requires a place to live, and that makes real estate a steady investment, even when markets shake.

The best part? Real estate works for you. It generates passive income through rent, and if you need to, it can serve as collateral for future loans or investments. In fact, real estate has consistently outperformed stocks over long periods. According to the Federal Reserve, real estate returned an average of 7% annually over the past 30 years, while the stock market saw about 5%. It’s stable, tangible, and, in many cases, more profitable.

Even with a small investment, these benefits still apply. Whether you’re investing a few hundred or thousands, the stability, income potential, and collateral value of real estate remain. With real estate, you’re not just watching numbers rise and fall—you’re building something solid for the future.

Budget-Friendly Real Estate Investment Strategies

You don’t need a six-figure income to get into real estate. There are several smart, accessible strategies that allow you to start small and still reap the benefits.

House Hacking: Use Your Own Home

House hacking turns your living space into a wealth-building tool. Buy a property, live in one part, and rent out the other units or rooms to offset your mortgage. For example, if you purchase a duplex and rent out half, your tenants’ rent could cover a good portion of your monthly costs.

REITs: Real Estate Like Stocks

Real Estate Investment Trusts (REITs) are an easy way to own a slice of real estate without ever buying property. You can invest in publicly traded REITs with as little as $100, which generate income by distributing 90% of their profits as dividends. According to Nareit, REITs have historically offered an average annual return of around 9% over the last 20 years.

Real Estate Funds: Industry-Scale Investing

Real estate-focused ETFs (Exchange-Traded Funds) and mutual funds offer a hands-off way to invest in the broader real estate sector. These funds pool investors' money to buy shares in a variety of real estate companies or REITs, providing broad exposure to the market. Historical data shows that some real estate ETFs have delivered annual returns of 6-8% over the long term.

Tokenized Real Estate: Fractional Ownership For Everybody

Tokenized real estate divides properties into digital shares, or tokens, using blockchain technology. Each token represents a fraction of the property’s ownership. What does this mean for you? Instead of buying an entire building or even a single apartment, you can own a small piece of it, sometimes for as little as $50. When you purchase tokens, you enjoy the same benefits as traditional owners—property value appreciation, rental income, and even the option to sell your share.

Real Estate Tokenization: A New Era of Investment For Every Budget

Tokenization has reshaped how real estate investment works, making the market more accessible, flexible, and transparent. In essence, tokenization divides property ownership into digital tokens, which are then stored and managed via blockchain technology. Investors buy these tokens, becoming fractional owners of the property. This process cuts out the red tape and high costs associated with traditional real estate, bringing property investment within reach for smaller investors.

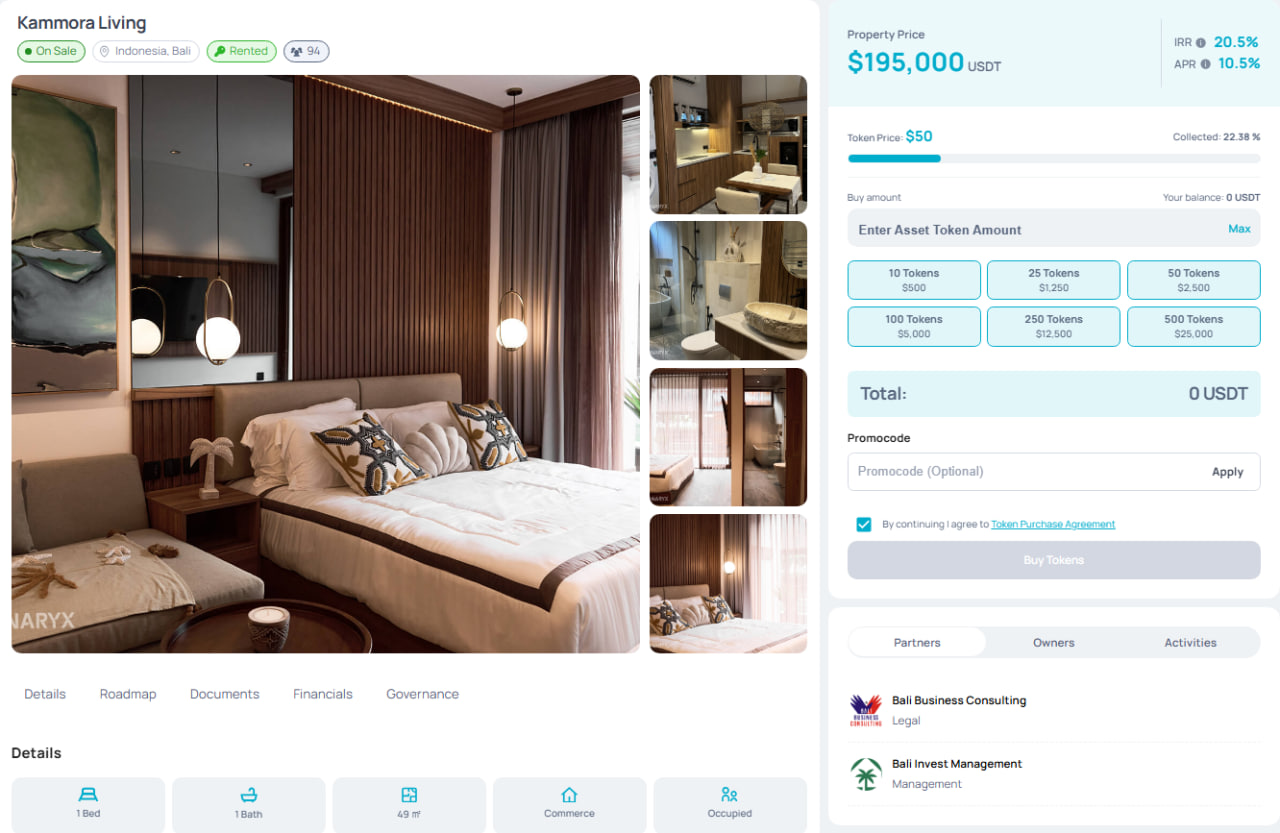

Now, let’s break down the tokenization process with a real-world example. Imagine a $195,000 rental villa in Bali being tokenized on Binaryx. First, the property’s value and rental potential are assessed. After the green light, an LLC is created to legally own the villa. The LLC then issues tokens, each representing a portion of the property’s value. If the villa is divided into tokens worth $50 each, 3,900 tokens are created. These tokens are made available to investors, who can buy as many as they want, gaining a proportional ownership of the property. With smart contracts managing everything on the blockchain, ownership and income distribution are automated and transparent.

The result? You get real estate returns without the hefty upfront costs or property management headaches. And, unlike traditional real estate, you’re not stuck waiting for a property to sell before seeing any profit.

Start Investing With Just $500 on Binaryx

Curious about how a tokenized real estate portfolio could perform? Let’s break it down using real-world examples from Binaryx. Let’s take $12,000 as initial capital and diversify it across multiple projects:

- Kammora Living Rental Villa in Bali: You invest $3,000 with a 10.5% APR. After one year, you earn $315 in rental income.

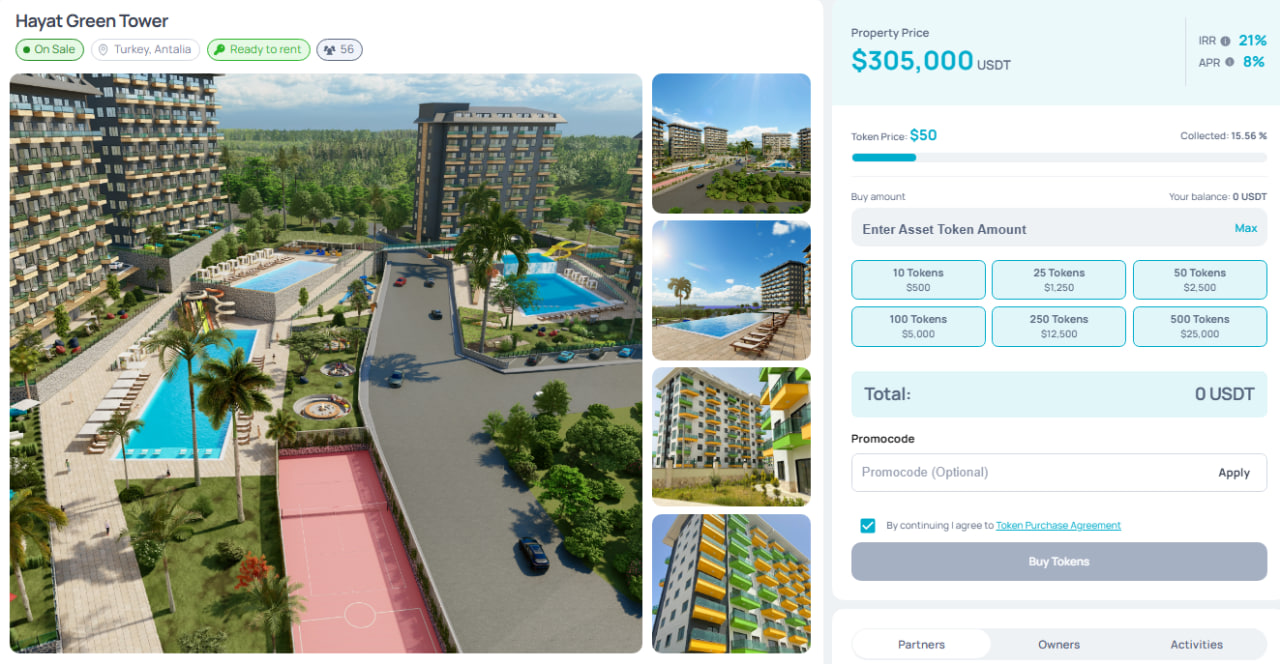

- Hayat Green Tower in Antalya, Turkey: With $3,000 invested, and an 8% guaranteed rental return, you’ll make $240 in one year.

- Mountain Retreat by Dukley in Montenegro: This $3,000 construction investment offers a projected ROI of over 13%. With the exit planned for Q1 2025 (roughly 4 months from now), you can expect $390 in returns by the exit.

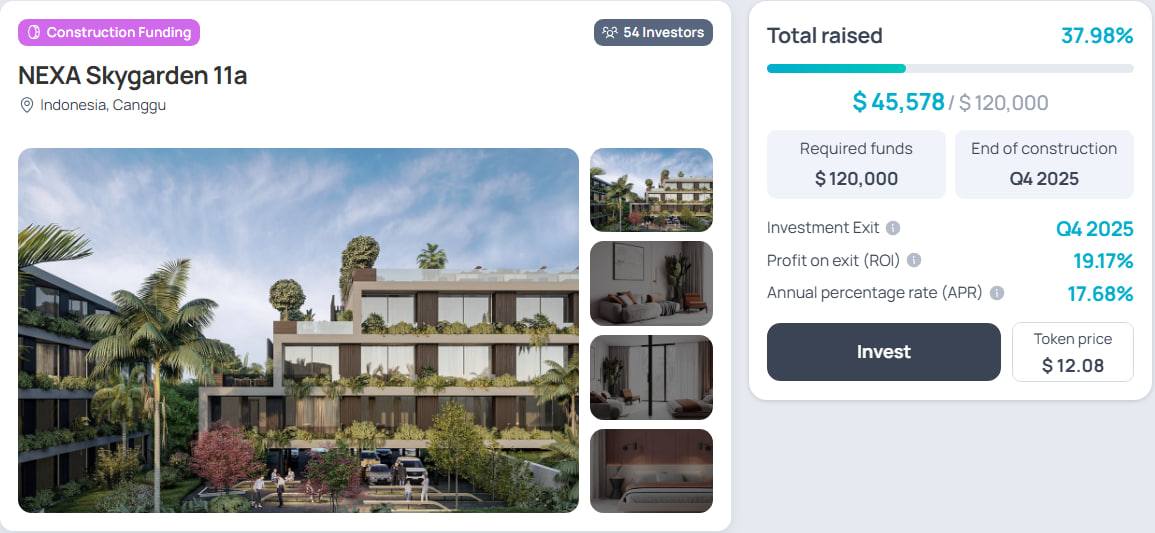

- Nexa Skygarden in Bali: Another $3,000 goes into this high-potential construction investment, offering up to a 33% projected ROI. With the exit scheduled for Q4 2025 (around one year), you will see a return of $990 by the end of the investment.

Over the course of these investments, your total returns will be $1,935. This brings your overall portfolio value to $13,935 by the end of 2025, with returns coming in at different stages based on the project timelines.

From Small Investments to Long-Term Wealth

Real estate isn’t just about a one-time deal or a side hustle. Think bigger—it's the starting point for building long-term wealth, something that grows as you do. Like any business, it demands strategy, constant learning, and a willingness to take calculated risks. Here’s a practical, stepped guide to help you build your real estate empire from the ground up, even if you’re starting small.

Step 1: Do Your Homework and Understand the Market

Before you dive in, know what you’re getting into. Don’t just skim articles or follow trends blindly. Talk to people who have done it—mentors, investors, even friends. They’ve lived through it and can offer more than just theoretical advice. The more you understand the market, the better your decisions will be. It’s not just about properties; it’s about timing, locations, and opportunities that only reveal themselves when you’ve done your homework.

Step 2: Start Small but Smart

You don’t need to jump straight into a commercial property or large-scale development. Begin with something manageable—a small residential property or a fractional ownership stake in a tokenized real estate project. This lets you learn the ropes while minimizing your risk. Plus, owning your first property builds your credit and opens doors to financing future deals. Small steps lead to bigger ones.

Step 3: Leverage Your Assets to Expand

Once you’ve got that first property under your belt, don’t just sit on it—use it as leverage. Your property can serve as collateral to secure loans, letting you expand faster without having to save for years. Leveraging is a game-changer in real estate. Debt, when managed well, is a tool that can fuel your growth much faster than cash.

Step 4: Build a Strong Network

Real estate isn’t a solo game. You need allies—other investors, mentors, contractors, even good tenants. Networking isn’t just about finding opportunities, it’s about learning from the experience of others. Pooling resources or forming partnerships can open doors to larger, more profitable projects. The right network can turn small opportunities into massive wins.

Step 5: Experiment and Find Your Strategy

There’s no one-size-fits-all approach to real estate. Try different strategies—house hacking, short-term rentals, tokenized investments, or even REITs. Experimenting helps you find what works best for your skills, interests, and financial goals. Stick with what you enjoy and what makes sense for you.

Step 6: Learn from Every Step

Mistakes? Expect them. Success comes from learning, not avoiding failure. Reflect on where things went wrong, learn from the experiences of others, and use those lessons to refine your strategy. The goal is constant growth—every project, every decision builds toward a larger portfolio and a better understanding of the market.

Real Estate is Within Your Reach

You don’t need a huge bank account to start investing in real estate. The days of high barriers are over, there’s a path forward no matter your budget. What matters is that you take that first step and stick with it. Every small move, every calculated investment, builds momentum.

Real estate can be a slow grind, but the returns—stability, income, and growth—are worth it. And if you’re looking for an easy way to begin, platforms like Binaryx make it simple. With fractional ownership starting at just $50, you can start building your portfolio today, no matter where you are on your financial journey. Your future in real estate is waiting, and it’s closer than you think.

Articles you may be interested in

.jpg)

.png)

.png)

.webp)