Recently, my nephew has asked me where to invest the $10,000 he was given for his birthday. I asked for his financial goals and shared my thoughts on how you should start your investment journey, and then my curiosity led me to look up some advice the internet offers. To my disappointment, the top Google results were filled with generic, boring SEO texts about various savings accounts, stock markets, mutual funds, emergency funds, tax deductions, and individual retirement plans. That’s why I decided to write my guide.

Investing 10k in S&P 500 (SPX) Index

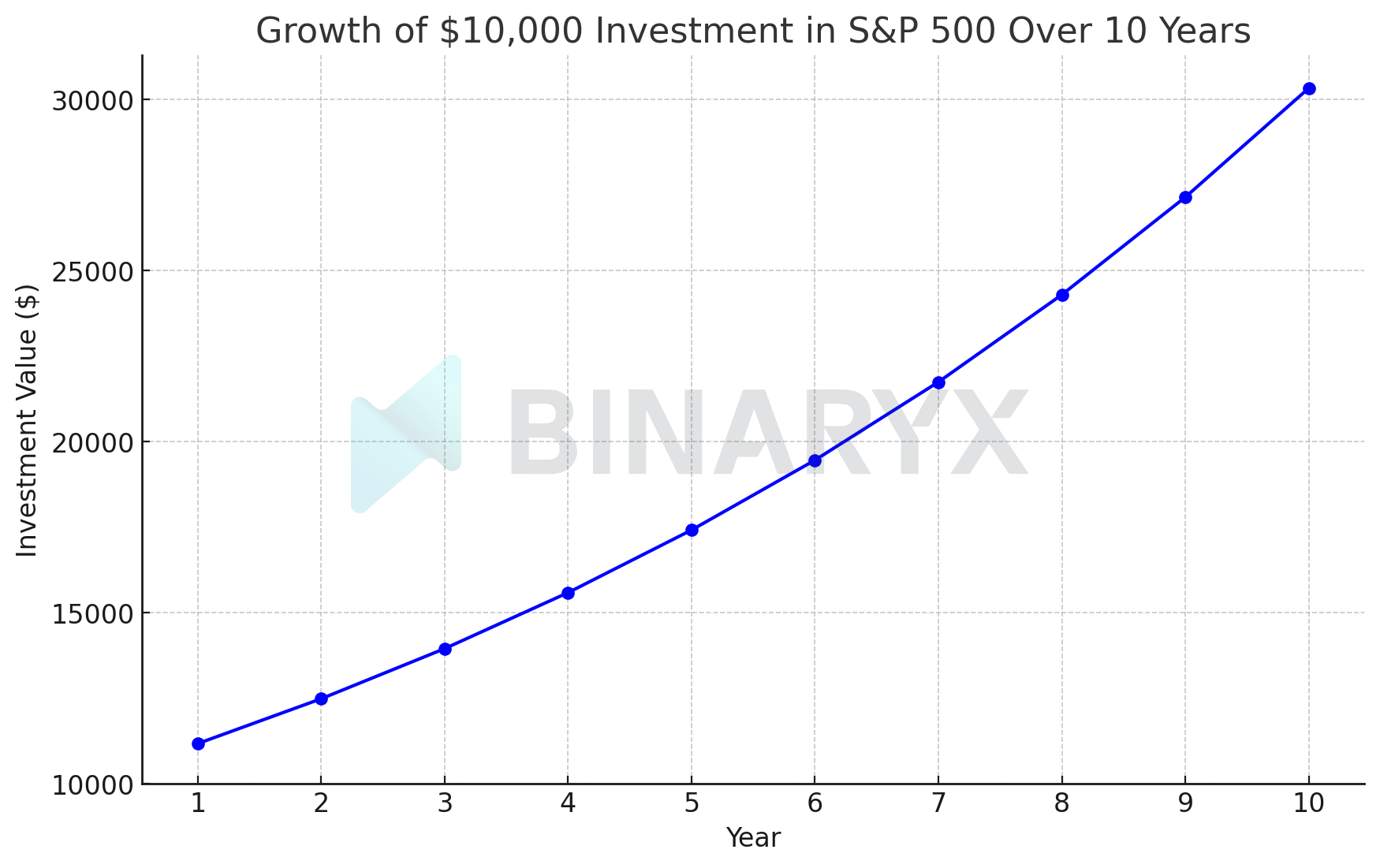

Perhaps the most efficient and simple way to grow your wealth is to invest in S&P 500 (SPX) index exchange-traded fund. The Standard & Poor's 500 Index tracks the performance of the 500 largest publicly traded U.S. companies, representing a broad spectrum of the U.S. economy. Based on historical data, the average annualized return of the S&P 500 over the past ten years has been about 12.9%. I have used the geometric mean of the yearly returns, which accounts for the compounding effect over the period. This means that on average, the index has delivered a return of 12.9% per year, although the return could be much higher or even negative in some years.

While past performance is no guarantee of future results, the S&P 500 has historically provided stable returns and has become a solid option for long-term investors. Putting $10,000 into the S&P 500 Index and leaving it untouched for 10 years would presumably more than triple the investment due to the power of compounded returns. The following chart shows the projected growth of the invested $10,000 over ten years, assuming the average annualized return remains constant:

So, after ten years, the initial investment of $10,000 will have grown to $33,646. This estimate assumes that earnings are reinvested and that the average annualized return remains constant over the entire period. Also, note that S&P500 index funds typically have lower fees than actively managed funds. Not bad, huh? This is the most passive investment you can make no matter market conditions.

Investing 10k in Warren Buffett's 90/10 or Ray Dalio's All Weather Portfolios

When you lack expertise or just don't want to be bothered, you can simply replicate the portfolio of any successful investor, whether it's Warren Buffett, Ray Dallio, or whoever. Warren Buffett's 90/10 portfolio and Ray Dalio's All Weather are chosen as the most popular ones.

Warren Buffett's 90/10 portfolio is a simple, long-term investment strategy of allocating 90% to a low-cost S&P 500 index fund and 10% to short-term government bonds. Ray Dalio's All Weather portfolio is a more complex strategy aimed at steady returns and risk minimization across all economic conditions, with a typical allocation of 30% stocks, 40% long-term bonds, 15% intermediate-term bonds, 7.5% gold, and 7.5% commodities.

Here's the chart showing the projected performance of the two investment portfolios over 10 years, based on historical annualized returns:

Investing $10,000 for 10 years starting in July 2024 would yield $31,114 for Warren Buffett's 90/10 portfolio and $15,470 for Ray Dalio's All Weather portfolio. As you can see, Warren Buffett's 90/10 portfolio significantly outperforms Ray Dalio's All Weather portfolio; however, the real returns may show the opposite picture at the end of 10 years.

Investing 10k in Bitcoin

The only crypto-asset in which we can be sure that it will continue to grow at some point is Bitcoin. I will not go into details about why this is so; it requires a separate article, but let's just stick with it for now.

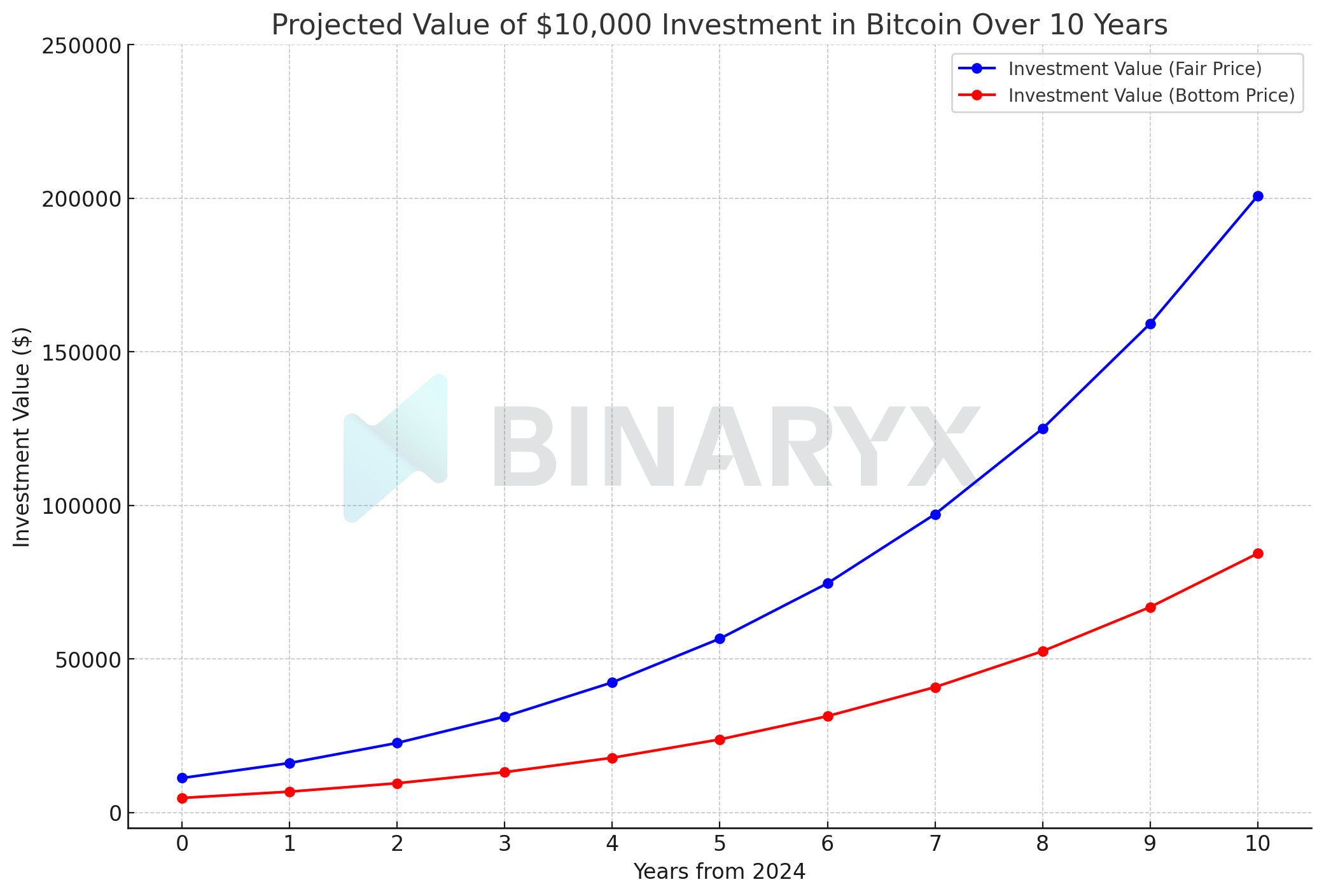

To provide a more realistic estimate of Bitcoin's potential returns over the next 10 years, we should use the Bitcoin Power Law Model instead of something else. This model, discovered by Giovanni Santostasi, reveals that Bitcoin's price moves in a straight line when plotted on a log-log graph. According to this model, Bitcoin's price always oscillates around its fair price, calculated by the formula:

1.0117e-17*(days since genesis block)5.82

An additional metric, the bottom price, is calculated as 42% of the fair price.

This model has predicted Bitcoin's bottom price for many years, with only one exception on March 13th, 2020, when the price briefly fell below the bottom price due to the COVID crash. So, using the Power Law Model, we can quite accurately forecast the value of a $10,000 investment in Bitcoin over the next 10 years.

If the investment remains untouched and the Power Law Model is correct, $10,000 invested in Bitcoin, over 10 years could turn into at least $84,000, but more likely get closer to the fair price of $200,000. However, you should be aware of the inherent risks and market volatility associated with Bitcoin and cryptocurrencies in general.

Investing 10k in Artificial Intelligence (AI) Stocks

Biting a slice of the AI pie has been the dream of almost every investor over the past two years after the LLM (Large Language Model) boom started. Thousands of startups are popping up and raising overvalued rounds, but the key players in the stock market can be counted on the fingers of one hand.

Let’s consider an investment strategy where you allocate $2,000 each to Nvidia's, Microsoft's, Google's, Meta's, and Apple's individual stocks, totaling $10,000. To project the potential returns over the next 10 years, we’ll use the historical annualized 10-year returns for each company, which are 84.04% for Nvidia, 29.35% for Microsoft, 26.77% for Apple, 23.98% for Google, and 18.48% for Meta. We'll assume these rates remain constant over the next decade to keep it simple. Furthermore, we will triple-divide Nvidia's stock return, thereby reducing the impact of the recent rally in the stock. So, let's reduce Nvidia’s annualized returns to 30%. Here is a visualized chart:

Thus, a $10,000 investment in the individual stocks of the five AI giants in July 2024 could grow to about $106,124 by July 2034, assuming the stated annualized rate of return is sustained. And that's without taking dividends into account.

Investing 10k in Tokenized Real Estate

Let me tell you, you don't need large sums of money to invest in real estate, and I am not talking about real estate investment trusts. Modern syndication platforms allow you to invest $50 in properties through the purchase of special tokens. Here is how it works: each property unit is acquired by a specially created limited liability company and then divided into fractional shares, which are tokenized on the platform.

Let's assume you acquire property tokens of five rental properties on the Binaryx Platform, totaling $10,000. Thus, your real estate investment portfolio may consist of five equal shares in Kammara Loft, Vesna Townhouse, PARQ Penthouse 61, Karra Loft 5, and Kammora Living. Their projected annualized rental yields are 13.5%, 11.4%, 12%, 16.3%, and 10.5%, respectively. Considering that Bali property prices have roughly doubled in the previous ten years, we can additionally consider that by 2034, property values will increase by 100%. Here's a projection of a $10,000 investment in five tokenized real estate units on the Binaryx Platform over the next 10 years.

Thus, we can assume that the total value of your diversified portfolio increases four and a half times both due to rental yields and real estate appreciation. The coolest thing about it is that you don't have to manage the property or even see it in person; you just get a passive income.

Output

Actually, the $10,000 is a mere formality. All of the mentioned investment strategies are available with $1,000 in your pocket, and even with a hundred bucks, there is almost no minimum investment. Besides, they can be combined with each other and modified in every possible way, specifying your individual investment plan and expanding your investment options. In the process, you will better understand whether passive investing or active investing is more suitable for you. And certainly, it is completely unnecessary to wait ten years to take profits.

Articles you may be interested in

.jpg)

.png)

.png)

.webp)