From $100 to $150K+: How to Start Investing in Residential Real Estate at Any Budget

Investing in residential real estate used to be a privilege for the wealthy, often requiring large sums of money, intricate paperwork, and valuable connections. However, advancements in technology and innovative investment models have transformed the market, making real estate accessible to investors from all financial backgrounds.

Whether you’re starting with $100 or have $150,000 to invest, there are various options available—from traditional ownership to fractional investments—that cater to different budgets and risk levels. Your investment strategy will vary based on the capital you possess, with high-net-worth individuals adopting different approaches compared to those who are just beginning their investment journey.

To assist you in navigating this landscape, we’ve organized investment strategies into three common budget categories:

- Premium investors ($150K+) – Individuals who have significant funds and seek full ownership and long-term appreciation.

- Mid-range investors ($50K–$150K) – Investors looking for a lucrative market entry without the commitment of full ownership.

- Entry-Level Investors ($50–$50K): Ideal for those interested in fractional ownership, tokenized real estate and other low-threshold opportunities.

Understanding where you fit in helps you make informed decisions that align with your financial objectives. So, here’s a detailed look at the best real estate options for each investor category.

1. Premium Investors: $150K+

As a high-income professional, entrepreneur or experienced investor with significant funds, you may have a successful business, stock options or earnings from disciplined investing over several years. You may have accumulated wealth. Your goal is to preserve and grow your capital by investing in prime real estate in prime locations such as Bali, Dubai and Miami, focusing on properties with high rental yields, upside potential and minimal management intervention. You are looking for stable annual returns and long-term wealth growth with an emphasis on financial stability, diversification and passive income.

What You Can Invest In

With this budget, investors can buy whole apartments, penthouses and luxury villas in high-demand markets such as:

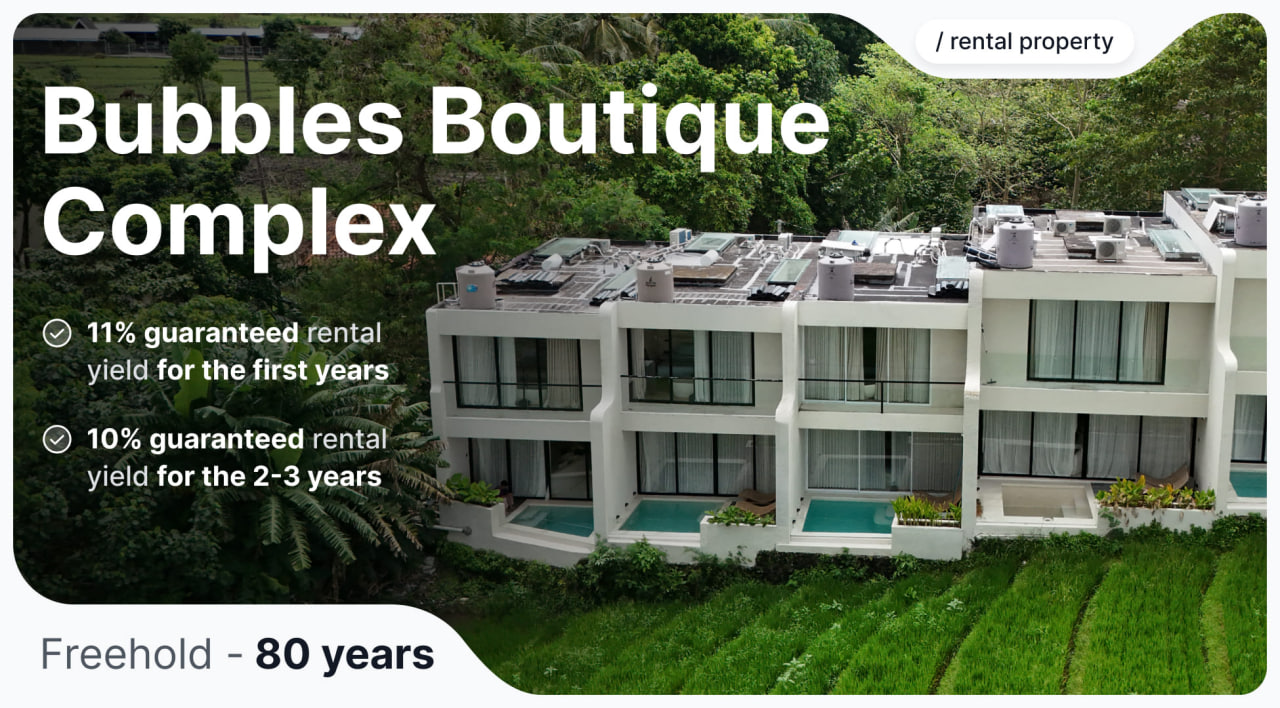

- Bali: Stunning beachfront villas with 10-15% annual price appreciation. The Indonesian island's mix of culture and luxury continues to attract high-end tourists and digital nomads.

- Dubai: with its favorable tax regime and booming tourism sector, rental yields of 7-10% can be expected in high-end areas. Recent regulatory changes have also made it easier for foreigners to invest.

- Miami: Airbnb's favorite spot with 8-12% rental yields in the best locations. Demand is always high due to year-round tourist traffic and a growing high-tech industry.

- Lisbon: In addition to attractive rental yields of 6-8%, Portugal's Golden Visa program offers a pathway to European residency through property investment.

Earnings Potential

- A $200K Bali villa could bring in $3,500 monthly through Airbnb, particularly in areas like Canggu or Uluwatu (See listings).

- In Dubai, expect $2,500-3,000 monthly from a $180K apartment in areas like Marina or Downtown (Dubai real estate prices).

- In Miami, a $250K condo in a tourist district can bring in $30K+ annually. For example, a current Airbnb listing in Miami's South Beach area charges $250 per night, leading to $7,500/month if occupied 30 nights per month. After property management fees and maintenance costs (estimated at $1,500/month), net earnings can reach $6,000/month (Check Miami listings).

Pros & Cons

✅ High capital gains in growing markets

✅ High rental income, especially in tourist areas

✅ Access to stable long-term tenants and short-term vacationers

❌ Large upfront capital required

❌ Tenant and maintenance management can be challenging in remote areas

Where to Find Properties & Tenants

- Purchase: Knight Frank, Sotheby’s International Realty, Zillow

- Renting: Airbnb, Booking.com, local property management firms

- Legal Help: Local real estate attorneys, investment consultants

2. Mid-Range Investors: $50K – $150K

Economically stable professionals, freelancers, small business owners with solid savings and a desire to make the most of their funds. You have dabbled in equities, crypto or other investments and are looking to move into real estate with cash flow stability and long-term appreciation potential. You are looking for affordable but high-potential properties with strong rental demand in emerging markets such as Tbilisi, Thailand and Montenegro. You target properties that provide immediate income, exit flexibility in a few years and a steady increase in value over time.

What You Can Invest In

With this budget, you can buy small apartments or invest in pre-construction stages that offer strong appreciation. Ideal locations include:

- Tbilisi, Georgia: This digital nomad's paradise offers rental yields of 8-12% and is growing in international appeal. The city's mix of history and modernization attracts both tourists and long-term expats.

- Montenegro: Coastal properties in Montenegro can expect annual yields in excess of 10% with increasing numbers of European tourists and the prospect of EU membership.

- Thailand: Whether it is the urban charm of Bangkok or the beach lifestyle of Phuket, returns of 6-10% and high value gains can be expected.

- Mexico's Riviera Maya: Places like Tulum and Playa del Carmen offer 12-15% returns, driven by a booming expat and tourist market.

Earnings Potential

- A $90K beachfront apartment in Montenegro can earn $900–$1,500/month (See current listings).

- A $75K studio in Bangkok can be rented out for $700–$1,200/month (Thailand property portal).

- A $100K Tulum villa can bring $2,000+/month in peak seasons (Find properties in Tulum).

Pros & Cons

✅ Affordable entry into the high-yield rental market

✅ High rental demand in areas popular with tourists

✅ Prices may increase in 5-10 years

❌ Higher risk than the main real estate market

❌ Foreign property ownership laws vary by country

Where to Find Properties & Tenants

- Purchase: Montenegro Prospects, DDProperty, Point2Homes

- Renting: Airbnb, local rental agencies, Facebook groups for expats

- Property Management: Local firms, expat communities, digital property managers

3. Entry-Level Investors: $50 – $50K

Aspiring investors, IT professionals, freelancers, and financial industry newbies are looking for an easy way to enter the real estate industry without needing six-figure funds. You may have profited from crypto or equities or are just starting to explore investment opportunities. Tokenized real estate, REITs and crowdfunding are attractive to you because they offer low entry costs, passive income and liquidity. Starting with small amounts to generate stable rental returns and gradually expanding your portfolio with minimal risk and effort is the best way to go for you.

What You Can Invest In

For those with а smaller budgets, small property ownership allows you to invest in a property without buying the entire asset. Options include:

- Tokenized Real Estate (Binaryx, Lofty, RealT) – Own a fraction of high-end rental properties for as little as $50.

- REITs (Fundrise, RealtyMogul) – Invest in real estate portfolios for passive income.

- Crowdfunded Real Estate (Yieldstreet) – Join investment pools for large-scale properties.

Earnings Potential

- A $500 investment in a Bali penthouse can generate $5–$10/month in rental income.

- A $1,000 tokenized investment in a Dubai apartment can return $100–$150/year.

- A $10,000 share in a Tulum resort can yield 10–12% annually.

Pros & Cons

✅ Affordable entry into high-end real estate markets

✅ Passive income without the hassle of management

✅ Ability to exit and buy and sell shares on the secondary market

❌ No control over property management decisions

❌ Depends on platform reliability and market trends

Why Fractional Ownership?

Platforms like Binaryx make it easy for investors to start profiting from residential real estate quickly. Unlike traditional methods where funds are tied to a single asset, tokenized real estate allows investors to diversify across multiple properties, benefiting them from rental income and potential appreciation. For instance, investing in a luxury villa in Bali through Binaryx could:

- Start generating rental income immediately.

- Benefit from the appreciation of Bali’s growing real estate market.

- Provide an option to sell your share on a secondary market if needed.

In conclusion, you see that the residential real estate market has evolved, making it accessible to investors at all levels. Whether you have $500 or $150K, you can start building wealth through real estate by choosing a strategy that fits your budget and financial goals.

With Binaryx platform, you can invest in fractional real estate with just $100 and earn passive income from day one. Explore opportunities today and take your first step toward real estate ownership—without traditional barriers.

Start Investing with Binaryx Now

Articles you may be interested in

.jpeg)

-min.jpeg)

.webp)