Simplifying Private Equity Real Estate Investing with Crowdfunding

Real estate private equity has long been an exclusive investment option, often reserved for institutional investors or those with deep pockets. With promises of high returns and diversification, it's no wonder so many want in—but the complexity, large capital requirements, and illiquidity have kept most people out. Now, thanks to crowdfunding, that's changing. This article will walk you through how real estate private equity works and why crowdfunding is making it easier than ever to get started, without the usual hassle.

Understanding Real Estate Private Equity

What is Real Estate Private Equity?

Real estate private equity (REPE) is all about investing in large real estate projects through private partnerships or funds. Instead of buying a property on your own, you team up with other investors to pool your money and invest in bigger deals like office buildings, apartment complexes, or shopping centers. The cool part is, that professionals called sponsors handle everything from buying the property to managing it, so you don’t have to.

Benefits of Real Estate Private Equity Investments

- Higher Returns: These deals often have the potential for better returns than typical real estate investments.

- Diversification: Your money goes into multiple properties, so you spread out the risk.

- Professional Management: You leave the heavy lifting to experienced pros who know the market.

- Tax Advantages: There are perks like depreciation and deferring taxes.

How Real Estate Private Equity Works?

The way REPE works is pretty straightforward. Sponsors (the people running the show) find properties, evaluate their potential, and raise money from investors like you. Once they’ve gathered enough capital, they buy the property and take over managing it. You, as an investor, are considered a limited partner (LP), which means you just sit back and wait for your share of the returns. The sponsor (or general partner) earns fees for managing everything and takes a percentage of the profits if the investment goes well.

Why Real Estate Private Equity Seems Complex?

For starters, it’s not as easy to jump in and out of these investments as with public stocks or REITs—you could have your money locked in for years. Also, you’ve got to trust the sponsor to make the right moves, which means doing your homework before investing. There are other layers to consider, like the different ways deals are financed (the “capital stack”) and the various fees that can eat into your returns if you’re not careful.

Real Estate Private Equity Investment Structures Explained

You can get involved in real estate private equity in various ways, depending on how much control you want, how much capital you’re willing to invest, and how long you’re willing to stay in the game. The most common structures—syndications, funds, joint ventures, and public REITs—each come with their own set of pros and cons.

Syndications: One Deal, One Property

Syndications are the classic way to invest in real estate private equity. In this setup, a group of investors pools their money to buy a single property, like an apartment building or office space. A sponsor manages the whole thing—from finding the deal to handling the daily operations—while investors are passive and just collect returns.

- Advantages: You know exactly which property you’re investing in, and you can choose deals based on your personal preferences (location, type, etc.).

- Disadvantages: It’s all-in on one property, so if something goes wrong (bad tenants, market issues), your investment is directly affected. Liquidity can also be an issue since it’s tough to sell your stake mid-project.

Syndications are great for investors who want a say in the specific deal they’re putting money into and are comfortable with the risks tied to one property.

Funds: Spreading It Out

Funds take syndications to the next level by pooling money to invest in multiple properties instead of just one. The sponsor (or fund manager) collects capital from investors and uses it to buy several properties, providing built-in diversification.

- Advantages: You get exposure to multiple properties and types of real estate, which spreads out your risk. Plus, you leave all the decision-making to the professionals.

- Disadvantages: You don’t get to choose specific properties, and you’ll likely face management fees and carried interest (a percentage of profits) that can reduce your returns. Like syndications, funds tend to be illiquid—your money is locked in for a while.

Funds are a good fit for investors looking for diversification across different markets and asset types, without needing to select individual properties themselves.

Joint Ventures: Partnering Up

Joint ventures (JVs) are partnerships between a sponsor and usually one large investor, such as an institution or high-net-worth individual. The big investor typically provides most of the capital and has more say in how things are run compared to syndication.

- Advantages: JVs offer more control and oversight for the major investor, while still letting the sponsor handle day-to-day operations. Investors can also get into bigger deals, thanks to the larger capital involved.

- Disadvantages: It takes serious cash to join in. And, while you have more influence, you’re also sharing profits with fewer people, which might mean higher fees or a greater portion going to the sponsor.

JVs are ideal for high-net-worth individuals or institutional investors who want to be part of large, more complex deals and have a say in how things are run.

Public REITs vs. Private Real Estate Funds: The Liquidity Game

Public real estate investment trusts (REITs) are like stocks—traded on major exchanges and easy to buy or sell. They invest in real estate, but anyone can invest in them with just a few clicks. Private real estate funds, on the other hand, pool investor money but are not publicly traded, making them much less liquid.

- Public REITs Advantages: High liquidity (you can sell anytime), lower investment minimums, and diversification within the REIT.

- Public REITs Disadvantages: Priced like stocks, meaning they can be volatile and influenced by overall market swings, not just the real estate market.

- Private Real Estate Funds Advantages: Typically more stable and directly tied to real estate performance, with higher potential returns.

- Private Real Estate Funds Disadvantages: Limited liquidity, high fees, and the need for a long-term investment horizon.

If you want easy access and liquidity, REITs are the way to go. For those looking for potentially higher returns and are okay with tying up their money for longer periods, private real estate funds offer a more focused investment.

Choosing the Right Structure

- For diversification and lower risk: Consider funds or REITs. They spread out your investment and reduce the impact of a single bad deal.

- For more control: Look at syndications or JVs, especially if you want to be more involved in specific deals or want higher potential returns.

- For liquidity: Public REITs are the easiest to buy and sell, making them a good fit for those who may need quick access to their cash.

Brief Action Guide for Private Equity Investments

1. Set Your Objectives

Before diving into real estate private equity, you need to set clear investment goals. Having a clear sense of objectives will help you choose the right opportunities for your portfolio. Ask yourself:

- Risk Tolerance: How much risk are you comfortable taking? REPE investments can range from stable, income-generating properties to more speculative, high-risk projects.

- Target Returns: Are you looking for steady cash flow, long-term capital appreciation, or a mix of both? This will influence the type of deals you should consider.

- Time Horizon: How long can your capital stay tied up? Private equity investments are typically illiquid, so be sure your investment aligns with your financial timeline.

2. Find a Sponsor or Platform

A trustworthy sponsor or investment platform is the backbone of any successful real estate investment, so do your homework. Here’s what to look for:

- Track Record: How long have they been in the business? Do they have a history of delivering successful projects and returns to investors?

- Experience: Make sure the sponsor has deep experience in the type of real estate you’re interested in (e.g., multifamily, office, retail).

- Transparency: Look for sponsors or platforms that provide clear, upfront information about deals, risks, and fees. Avoid anyone who isn’t transparent or dodges questions.

3. Evaluate Deals

Once you’ve found a sponsor, it’s time to evaluate individual deals. Taking a close look at these factors can help you determine whether a deal has the potential to meet your objectives. Here’s what to look for:

- Location: Location is everything in real estate. Make sure the property is in a strong market with growth potential, good infrastructure, and demand.

- Market Trends: Check if the deal aligns with current real estate market trends. Are rents rising? Is the area experiencing population or job growth?

- Capital Structure: Look at how the deal is financed. High levels of debt can mean higher risk, so ensure the capital stack isn’t overly leveraged.

4. Understand the Fees

Real estate private equity investments come with fees that can eat into your returns, so it’s important to know what you’re paying for:

- Management Fees: These cover the sponsor’s day-to-day operations, typically ranging from 1-2% of the invested capital.

- Carried Interest (Promote): Sponsors earn a share of the profits (usually 20%) if the deal hits certain performance targets.

- Other Fees: Watch out for additional fees like acquisition fees, refinancing fees, or disposition fees.

5. Make Your Investment

Once you’ve evaluated the deal and are ready to commit, the final step is signing the necessary legal agreements:

- Subscription Agreement: This document outlines how much you’re investing and your legal obligations.

- Limited Partnership Agreement (LPA): The LPA details the terms of the partnership, including how profits will be distributed and what rights you have as a limited partner.

By following these steps, you’ll be well-prepared to make informed, strategic investments in real estate private equity. After signing, your capital is locked in, and you’ll start receiving updates on the investment’s progress. Keep in mind that these are long-term commitments, so patience is key to seeing returns.

Common Pitfalls in Private Equity Real Estate Investing

- Lack of Diversification: Investing too heavily in one property, market, or asset class can increase your exposure to risk. Diversifying your investments across multiple properties and markets is key to balancing risk.

- Misaligned Interests with Sponsors: If the sponsor’s compensation structure is based heavily on fees or carried interest, they might prioritize their own profits over the long-term health of the investment. Always check that the sponsor has "skin in the game" and a compensation model that aligns with investor success.

- Overleveraging: While debt can boost returns, too much leverage can backfire. In a market downturn, highly leveraged properties can suffer, making it difficult to cover loan payments or refinance.

- Illiquidity: Real estate private equity investments are typically long-term and illiquid, meaning your money could be locked up for years. If you need access to your capital before the investment term is up, you might face significant challenges in selling your stake.

- Market Timing: Even the best property in a hot market can underperform if you buy at the wrong time. Understanding where the market is in its cycle (booming, stabilizing, or declining) is crucial to avoid overpaying.

- Inadequate Due Diligence: Failing to properly vet the property, market, or financial assumptions can lead to surprises down the road. Make sure you or your sponsor thoroughly investigate all aspects of the deal before committing.

- Complex Fee Structures: Some deals come with layers of fees—management, acquisition, and disposition fees, plus carried interest—that can erode your returns. Always understand the full fee structure before investing.

- Exit Strategy Uncertainty: Having a clear exit strategy is crucial. Without it, you might be stuck holding an asset longer than expected, especially in a market downturn.

Crowdfunding as All-in-One Solution for Private Equity Real Estate Investment

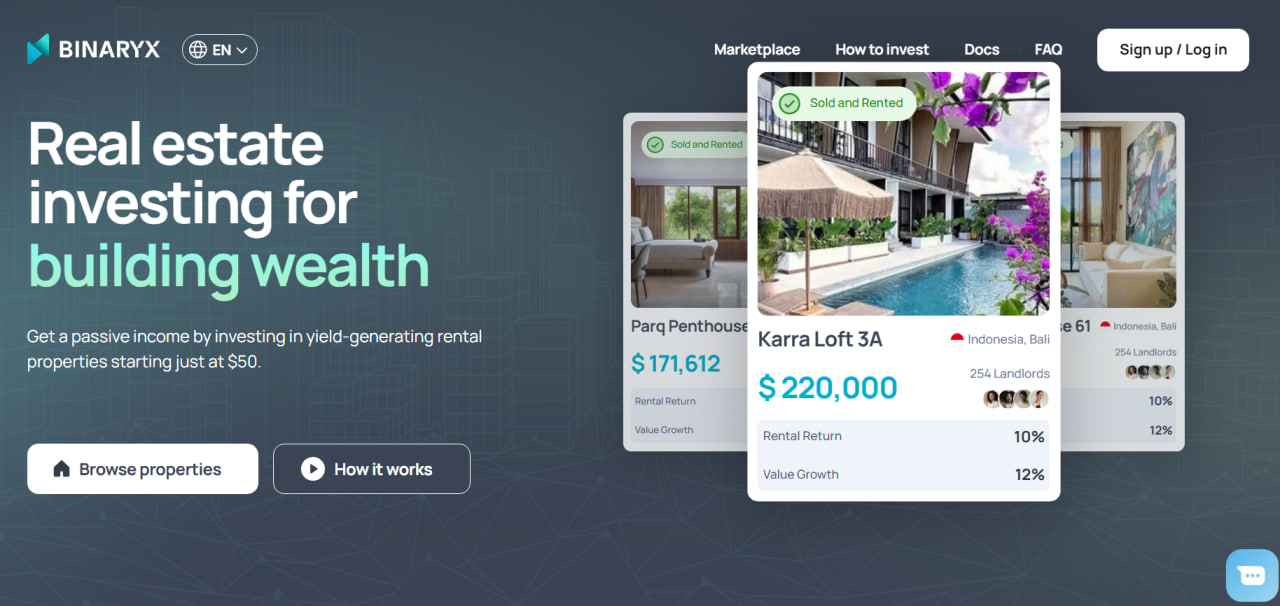

Historically, investing in real estate private equity was limited to institutional investors or ultra-wealthy individuals due to the high capital requirements and the complexity of deal structures. Investors had to rely on personal connections with sponsors, and the barriers to entry—such as accreditation and illiquidity—kept everyday people out. Crowdfunding has changed this game by breaking down these barriers and providing an online platform for evaluating and accessing real estate deals. Now, anyone can browse investment opportunities, read detailed analyses, and commit smaller amounts of capital without the need for personal connections or large upfront investments. With crowdfunding, you no longer need to be a high-net-worth individual to get involved in real estate private equity.

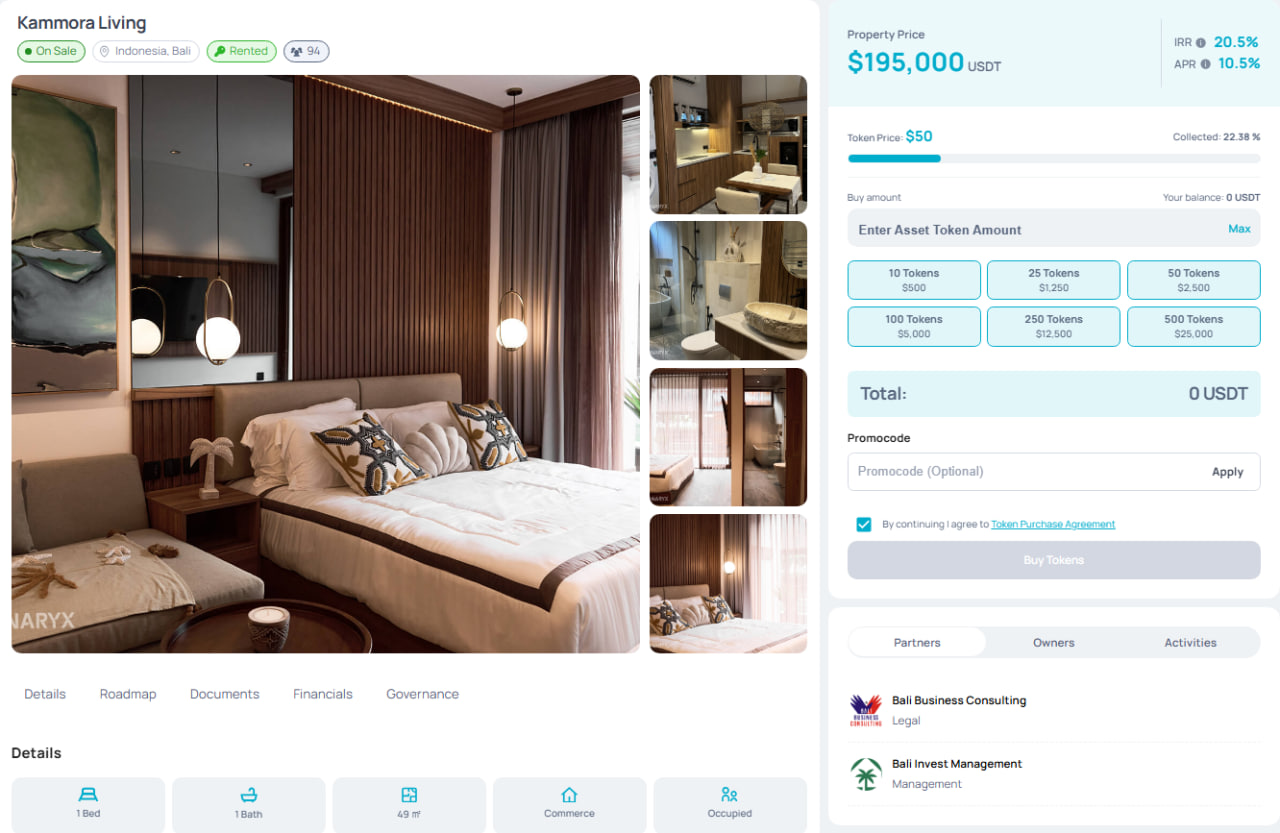

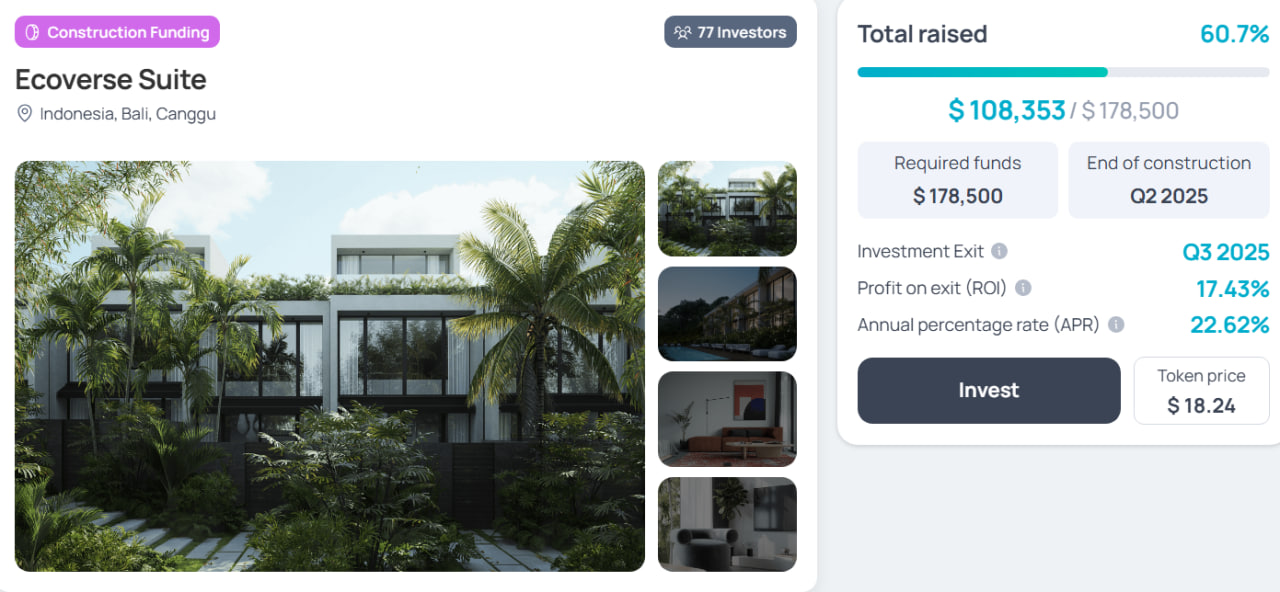

The crowdfunding process itself is designed to make investing simple and transparent. Let's break down the forces using the Binaryx Platform as an example.

- Everything starts when Binaryx identifies and evaluates a property for its investment potential.

- The property is then legally structured into an entity, often a Limited Liability Company (LLC), that issues fractional shares representing ownership. In Binaryx the fractional shares are issued in tokenized form on Polygon blockchain.

- These shares are offered to investors via the Binaryx crowdfunding platform, and you can purchase as many shares as you wish, gaining proportional ownership of the property’s income and appreciation.

- Professional management takes care of day-to-day operations like tenant relations and maintenance, while rental income is distributed to investors based on their share.

- If you want to exit the investment early, you can sell your shares on the secondary market without waiting for the entire property to be sold.

Check out how it works on Binaryx:

Conclusion

Crowdfunding is opening doors to real estate private equity that were locked tight for most investors just a few years ago. You can avoid bringing massive capital or exclusive connections to the table; with platforms built to handle the details, even smaller investors can jump into serious real estate projects with ease. You choose how much to invest, access professional management, and watch as real estate gains become part of your portfolio—without the operational headaches. Crowdfunding has transformed what was once a high-barrier industry into a straightforward, hassle-free option.

That said, even in this streamlined setup, careful choices still matter. You’ll want a clear sense of your financial goals, an understanding of fees, and a good look at a sponsor’s track record before committing. Crowdfunding doesn’t erase risk, but it offers a much-needed alternative in the world of real estate private equity. For those who want the benefits of real estate without the usual obstacles, crowdfunding is a great gateway, while Binaryx is the best path choice.

Articles you may be interested in

.jpg)

.png)

.png)

.webp)