From Zero to Real Estate Investor: Key Steps to Your First Property

When I first ventured into real estate investing, the landscape was vastly different. There was no Internet overflowing with easy-to-access guides; I had to rely on a few books and glean whatever insights I could from experienced friends. Most of what I learned came through trial and error. Today, however, things have changed dramatically. The web is filled with countless guides—some useful, others merely stuffed with SEO keywords. After navigating this sea of information, I decided to create my own comprehensive guide, tailored specifically for those who are just starting their journey in real estate investing.

Benefits of Real Estate Investing

When deciding where to invest your hard-earned money, real estate often emerges as a top contender that offers a unique blend of stability, tangible value, and potential for long-term growth. If you've found yourself contemplating this path, you're not alone—and this article is here to guide you. All the benefits of real estate investing can be traced back to these core characteristics.

- Tangible Asset You Can Touch and See

Real estate stands out as a tangible asset—properties you can physically touch, see, and enhance. Unlike stocks or digital investments, real estate offers the security that comes with owning something real and solid, providing a sense of permanence and stability. - A Fundamental Need for Everyone

Real estate fulfills a basic human need, making it a necessity rather than a luxury. Everyone requires a place to live, work, and conduct business, which ensures constant demand for residential, commercial, and industrial properties regardless of economic fluctuations. - Generates Passive Income

Real estate offers a reliable source of passive income through rent. By leasing out residential or commercial spaces, you can create a steady cash flow that supports your lifestyle, covers mortgage payments, or funds future investments. - Serves as Collateral for Future Investments

Beyond generating income and appreciating in value, real estate serves as solid collateral for future ventures. By leveraging your property’s equity, you can expand your portfolio or explore new business opportunities, making real estate a versatile and powerful asset in your financial strategy.

How Do You Make Money on Real Estate?

Basically, there are two primary ways to make money in real estate: value appreciation and rental income. To see value appreciation, you can either wait for market growth and let inflation boost your property's worth, or actively increase its value through renovations. Alternatively, you can lease your property to generate a steady stream of rental income. When most people discuss real estate investing, they’re likely referring to one of these two methods.

However, there are also lesser-known opportunities for profit. For example, you can achieve development gains by purchasing land and enhancing its value through construction or rezoning. Additionally, if you acquire an industrial property like a factory, you could start a manufacturing business, effectively turning the real estate itself into a revenue-generating venture.

Types of Real Estate

- Residential real estate includes properties such as single-family homes, condos, and apartments. It's a familiar market with relatively low barriers to entry, making it the ideal starting point for new investors.

- Commercial real estate covers properties like office buildings, retail spaces, and multi-family apartments. Despite common misconceptions, there are great options available even for smaller budgets, making this a viable next step once you're comfortable with residential investments.

- Land investment involves purchasing undeveloped property with the potential for future development. It's a solid, virtually indestructible investment, but it’s typically not suited for beginners due to the long-term nature and complexity involved.

- Industrial real estate includes warehouses, factories, and distribution centers. While very lucrative, forget about it for at least the first five years as it requires significant experience and capital.

- Virtual real estate refers to digital properties within emerging metaverses like The Sandbox. Though it gained popularity in late 2021, the hype has since faded, revealing that most metaverse worlds are still not mature enough to warrant serious attention.

Best Real Estate Investment Strategies for Beginners

Residential Properties Leasing

Begin with residential properties, but try to avoid houses, which can be labor-intensive to maintain, even if they might appeal to you more. Instead, focus on small, middle-class apartments that are easier to lease and require less upkeep. These types of rental apartments typically attract stable, long-term tenants, providing consistent cash flow without the management headaches that come with larger properties.

Commercial Properties Leasing

For beginners interested in commercial real estate, consider investing in storage facilities located in suburban areas experiencing high residential growth. Storage units are low-maintenance investments and tend to be resilient during economic downturns. Suburban areas offer the space required for such facilities at a lower cost than urban locations, with strong demand from local residents who need extra storage space.

Renovation and Flipping

If flipping properties appeals to you, ensure you budget using the 70% rule. This guideline suggests paying no more than 70% of the after-repair value (ARV) of a property, minus the costs of necessary repairs. For example, if a home’s ARV is $150,000 and it needs $25,000 in renovations, aim to purchase it for no more than $80,000. This approach helps protect your profit margin and reduces financial risk.

Real Estate Investment Trusts (REITs)

REITs offer a great way to invest in real estate without directly owning property. To get started, open a brokerage account where you can buy and sell publicly-traded REITs, much like stocks. For maximum benefit, consider keeping your REIT investments in a tax-advantaged account like an IRA, which allows you to defer taxes on large dividend distributions and grow your investment more efficiently over time.

Real Estate Fractional Investing (Crowdinvesting)

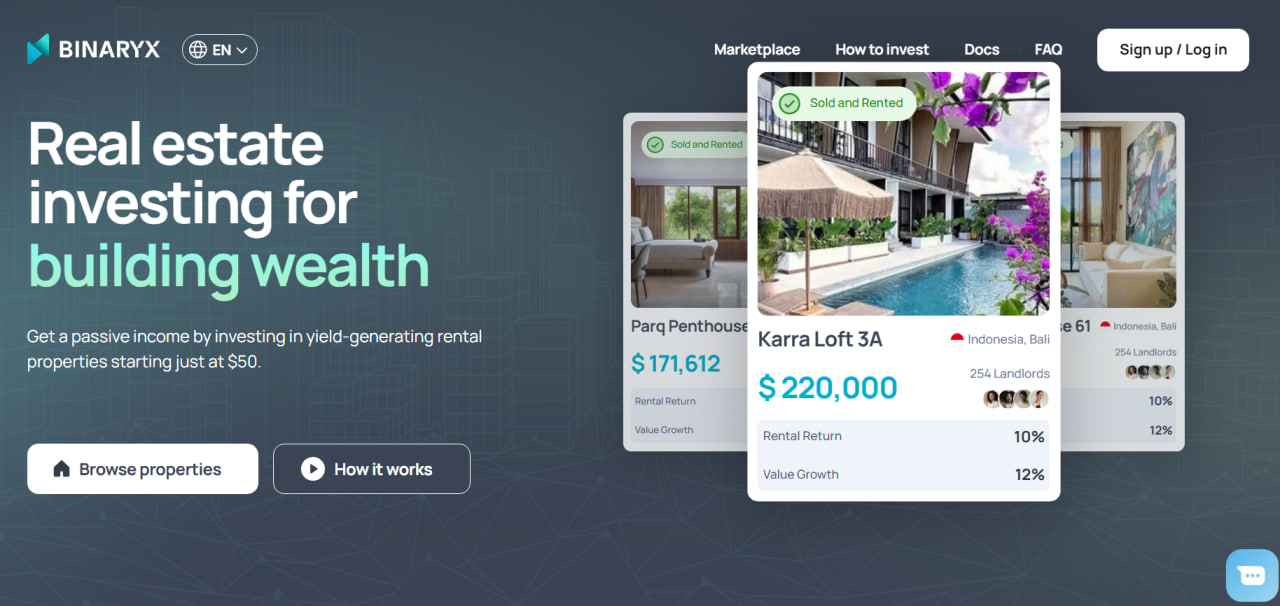

Fractional investing, particularly through tokenized platforms, is an excellent entry point for beginners with limited capital. Start by finding a platform that aligns with your investment goals. Tokenized options tend to offer greater transparency and flexibility, allowing you to diversify into various real estate projects, such as rental properties or new constructions, with a relatively small investment.

Fractional Investing Is the Best Way to Try Real Estate for the First Time

Fractional investing is arguably the best way to enter the real estate market, especially if you have limited capital. Also known as crowdinvesting, this approach allows multiple investors to collectively own a high-value property by purchasing fractions of it. These fractions can be either tokenized or non-tokenized, with the cost per fraction often starting as low as $50 or $100. Whether you're interested in earning rental income, investing in construction projects, or even flipping properties, fractional investing platforms open the door to real estate opportunities that were once reserved for the wealthy.

Here’s how it works: A property is divided into fractions, and investors can purchase as many fractions as they wish, each corresponding to a percentage of ownership. Tokenized platforms utilize blockchain technology to issue digital tokens representing these fractions, enhancing transparency and automating processes through smart contracts. To get started, you simply need to find a platform that aligns with your investment goals, open an account, and decide how much you want to invest. The platform takes care of property management, rental income distribution, and other logistical details. If you wish to exit your investment, you can sell your fractions at any time, in contrast to traditional real estate investments where you have to close on an entire property.

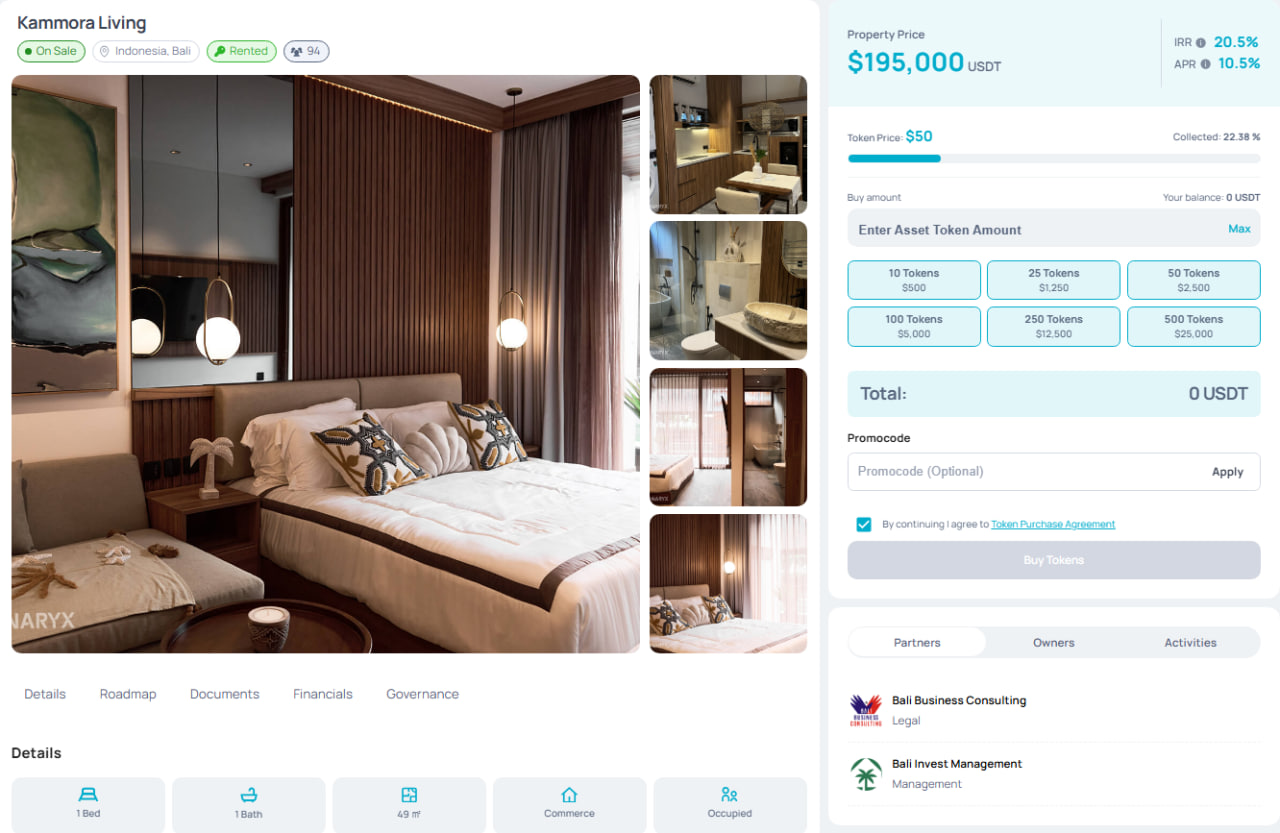

Let’s illustrate this with a specific case study. Suppose you have $5,000 to invest in real estate—what can you do with this sum on the Binaryx platform? Binaryx is a global platform offering fractional real estate investment opportunities in various regions, including Bali and Montenegro. It provides a unique chance to invest in both rental properties and real estate under construction, with entry points as low as $500.

Binaryx Investment Portfolio Case Study: A Beginner’s $5,000 Investment

Imagine you decide to invest $2,500 in a rental villa in Bali with a 10.5% annual percentage rate (APR) and another $2,500 in a construction project in Montenegro, offering an initial 19.24% return on investment (ROI) over 7 months.

During the first year, your returns would look like this:

- Rental Villa in Bali: $2,500 * 10.5% = $$262.50 over 12 months

- Construction Project in Montenegro: $2,500 * 19.24% = $481 over 7 months

- Total First-Year Income: $262.50 + $481 = $743.50

Now, let’s say you decide to cash out after the construction project is completed but keep the rental income from the villa coming in. Not bad for one year, considering it is real estate, right? Check it out yourself on the Binaryx Platform.

Key Steps to Achieve Success in Real Estate Investing

Think of your real estate investments as more than just a side project—consider them the foundation of your own business or even a personal empire that you’ll continuously expand. Success in real estate, like any business, requires strategic planning, constant learning, and the willingness to take calculated risks. Here’s a step-by-step guide to help you achieve your real estate investment goals.

- Research and Understand the Market

Before diving into real estate, it’s crucial to thoroughly research and understand the market. This involves more than just Googling trends or reading articles. Reach out to people in your network who have already invested in real estate; you probably know at least one person who has experience in this field. Their firsthand insights can be invaluable and provide you with a realistic picture of what to expect. - Start Small

Begin your journey by acquiring your first residential property. Starting small allows you to learn the ropes while minimizing risk. This initial purchase is also key to accessing mortgages, which will help you build your credit score. As you make timely payments and manage your property effectively, you’ll set the stage for larger investments down the line. - Expand Your Real Estate Portfolio by Leveraging Your Properties as Collateral

Once you have your first property under your belt, use it to expand your portfolio. Instead of relying on cash, leverage your existing properties as collateral to secure loans for purchasing additional properties. By using debt, you will grow more quickly and efficiently, rather than tying up your own capital. - Build a Network

Real estate investing isn’t a solo endeavor; building a strong network is essential. Find companions who share your investment goals and consider pooling resources to invest together. Forming syndications or partnerships can open up opportunities that might be out of reach individually. A solid network also provides support, advice, and potentially lucrative deals that you wouldn’t find on your own. - Try Different Strategies to Find the One That Suits You

The path to success in real estate isn’t one-size-fits-all. Experiment with different strategies, such as those discussed earlier, and stay open to new ideas. Trying various approaches will help you discover what aligns best with your skills, interests, and financial goals. - Learn from Your Mistakes and Others’

Mistakes are inevitable, but they’re also valuable learning opportunities. Reflect on any missteps you make and seek to understand where things went wrong. Additionally, learn from the experiences of others—both their successes and their failures. This will help you avoid common pitfalls and refine your investment strategy over time.

Conclusion

Entering the world of real estate investing can feel daunting, but with the right strategies and knowledge, it can also be incredibly rewarding. We’ve delved into practical investment strategies, emphasizing the importance of starting small, understanding the market, and building a network. Whether you choose residential leasing, commercial properties, or the innovative approach of fractional investing, the opportunities in real estate are vast and varied.

Fractional investing, in particular, stands out as an accessible entry point for those with limited capital, allowing you to own a piece of high-value properties and reap the rewards without the need for significant upfront investment. By following the steps outlined in this guide, you can lay the foundation for your real estate empire. Start this enterprise with the Binaryx Platform.

Articles you may be interested in

.jpg)

.png)

.png)

.webp)