The RWA trend is picking up speed, and there’s no shortage of protocols claiming a piece of the action. But here’s the catch: a lot of those so-called RWA tokens either barely scratch the surface or have little to do with real-world assets at all. Let’s cut through the noise and break down which RWA projects are genuinely worth your attention.

What Exactly Are RWAs?

Real World Assets (RWAs) are traditional financial assets—think real estate, bonds, commodities—that have been brought onto the blockchain. Tokenization turns these assets into digital tokens that are easy to trade, transfer, and manage within decentralized finance (DeFi) systems. It’s a way to streamline transactions, cut costs, and make previously illiquid markets more accessible.

What makes RWAs so interesting is the potential for innovation. We're not just talking about copying old systems onto the blockchain. The real value lies in projects that bring something new to the table—whether it’s unlocking more liquidity, improving transparency, or creating new investment opportunities that were once out of reach for most people. And that’s exactly what we’re going to explore: the standout projects that offer true uniqueness in this space.

Sky Money: Rebranding MakerDAO with New Innovations

Sky (formerly MakerDAO) is one of the oldest players in the Real World Asset (RWA) space. Its key product is the overcollateralized USDS stablecoin, previously known as DAI. Overcollateralized stablecoins like USDS work by requiring more collateral than the stablecoins issued. So, to mint $100 of USDS, you might need about $150 in collateral, typically ETH. This extra cushion helps keep the stablecoin stable, even when the market gets volatile, ensuring it holds its peg.

The recent rebranding to Sky is all about making the protocol more resilient and sustainable. Sky splits the ecosystem into multiple legal entities to future-proof its operations. A big part of this evolution includes the launch of Sky Stars—independent units (formerly SubDAOs) built to foster innovation. Spark Protocol, one of the first Sky Stars, already boasts over $3 billion in total value locked (TVL) and has ambitious plans to onboard up to $1 billion in RWAs. Sky itself, as of the end of September, holds over $6.5 billion in TVL, ranking as the fourth-largest protocol. USDS, the former DAI, remains a key player, sitting as the third-largest stablecoin with a $5.3 billion market cap.

On the token side, Sky introduces a voluntary swap system: MKR holders can exchange their tokens for 24,000 SKY tokens, while DAI holders exchange their tokens for USDS in 1:1 proportion. USDS holders can also earn SKY rewards via the new app, sky.money. The new tokenomics include a 3% yearly emission rate while retaining all governance features. Legacy DAI and MKR tokens will still exist for those who opt not to upgrade, but the future clearly points to Sky and its revamped, forward-looking system.

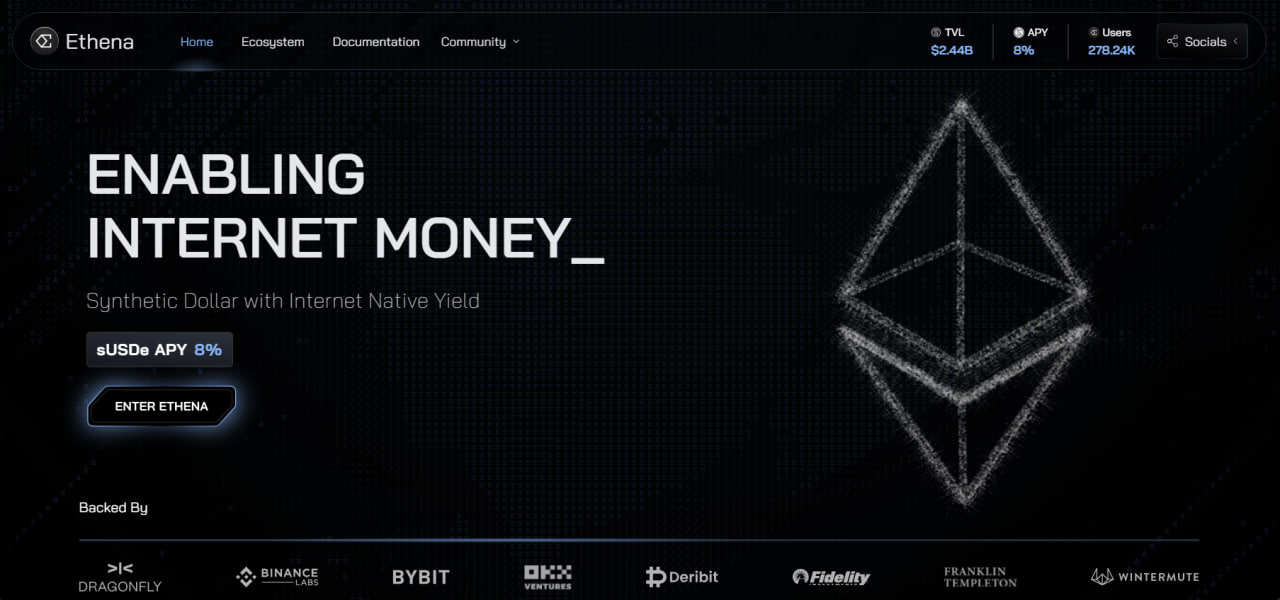

Ethena: Not Stablecoin, But Synthetic Dollar Asset

Ethena is an Ethereum-based protocol that introduces a unique concept: the synthetic dollar asset, USDe. Unlike traditional stablecoins like USDC or USDT, which are backed by real-world assets such as corporate bonds or cash reserves, USDe is mostly collateralized with volatile crypto assets. What sets it apart is its delta-neutral strategy, which allows USDe to maintain a 1:1 peg regardless of market fluctuations. By balancing long and short positions in crypto, Ethena keeps its asset stable. This approach reduces the need for overcollateralization, making USDe more capital efficient and distinct from conventional stablecoins.

Ethena also introduces the Internet Bond (sUSDe), a separate token designed to reward USDe stakers. sUSDe generates interest from Ethereum staking rewards (stETH) and from funding fees and basis spread earnings on perpetual futures exchanges. These profits are derived from the price differences between futures and spot markets, allowing holders to capitalize on volatile funding costs. In essence, sUSDe acts like a U.S. Treasury bill, offering a new way to earn yield. Ethena’s governance token, $ENA, plays a vital role in protocol maintenance, allowing holders to vote on decisions like collateral assets for USDe, cross-chain integrations, and risk management frameworks.

While Ethena offers a compelling alternative in the stablecoin space, it doesn’t fully align with the RWA category like projects such as Sky (MakerDAO). This is because Ethena doesn’t directly involve real-world asset collateral. However, USDe represents a synthetic version of the U.S. dollar, maintaining its peg, which creates a somewhat gray area. While not a typical RWA project, Ethena’s synthetic dollar is still tied to the value of a real-world currency, making it a unique fit within the broader RWA narrative.

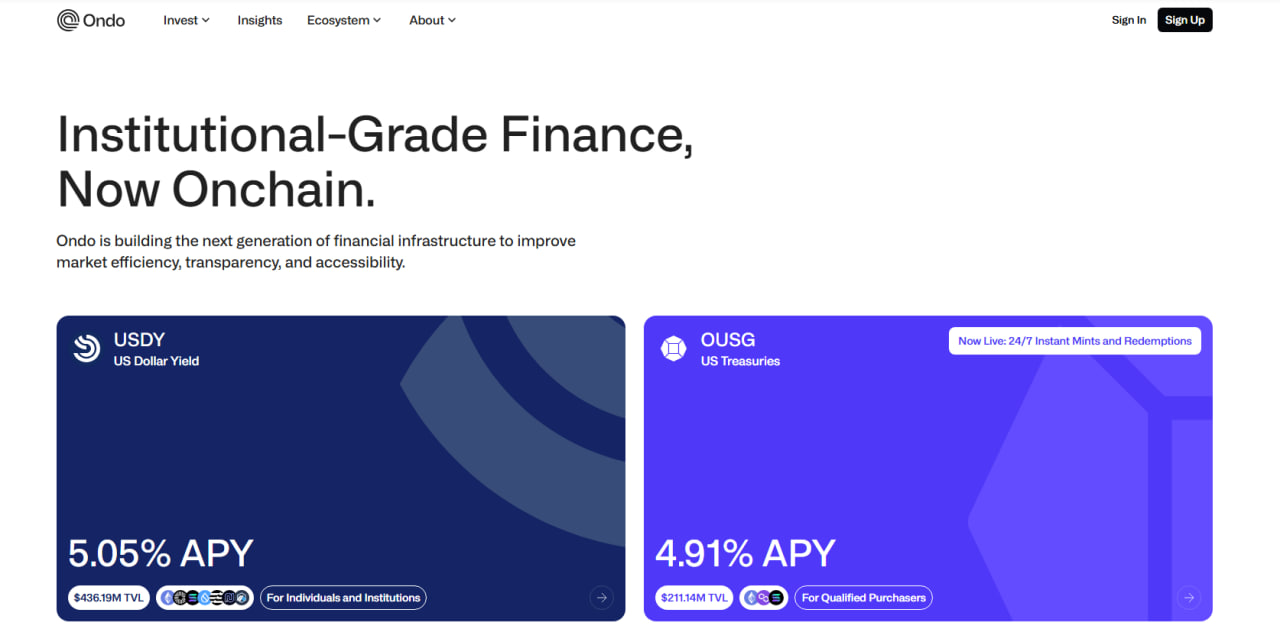

Ondo: Tokenizing Real-World Assets at Institutional Level

Ondo Finance is a cross-chain platform that brings US-regulated securities into the DeFi world. Its flagship product is USDY, a token backed by short-term US Treasury bonds and bank deposits. USDY provides the stability of a traditional stablecoin but with the added benefit of generating yield, typically around 5% APY. For institutional investors, Ondo offers OUSG, which was initially backed by Blackrock’s short-term US Treasuries ETF. In 2024, Ondo transitioned $95 million worth of assets to Blackrock’s new BUIDL fund, which includes cash, US Treasuries, and repurchase agreements.

Ondo expands its offering with Flux Finance, a lending protocol that allows institutional users to borrow and lend stablecoins, using OUSG as collateral. To bolster its cross-chain capabilities, Ondo provides a Token Bridge and Converter, enabling seamless movement of tokens between blockchains and easy conversion between USDY and other assets. Governance of the platform is handled by the ONDO token, which grants holders voting rights on protocol decisions, upgrades, and the management of the platform, keeping Ondo community-driven.

What sets Ondo apart is its strong institutional ties to BlackRock, which enable the tokenization of traditional financial products like exchange-traded funds (ETFs) and money market funds. By minting tokens that represent these assets, Ondo allows investors to trade them without needing brokers or direct custody of the underlying securities. This simplifies access to institutional-grade investments, making them accessible to a broader range of both general and qualified investors.

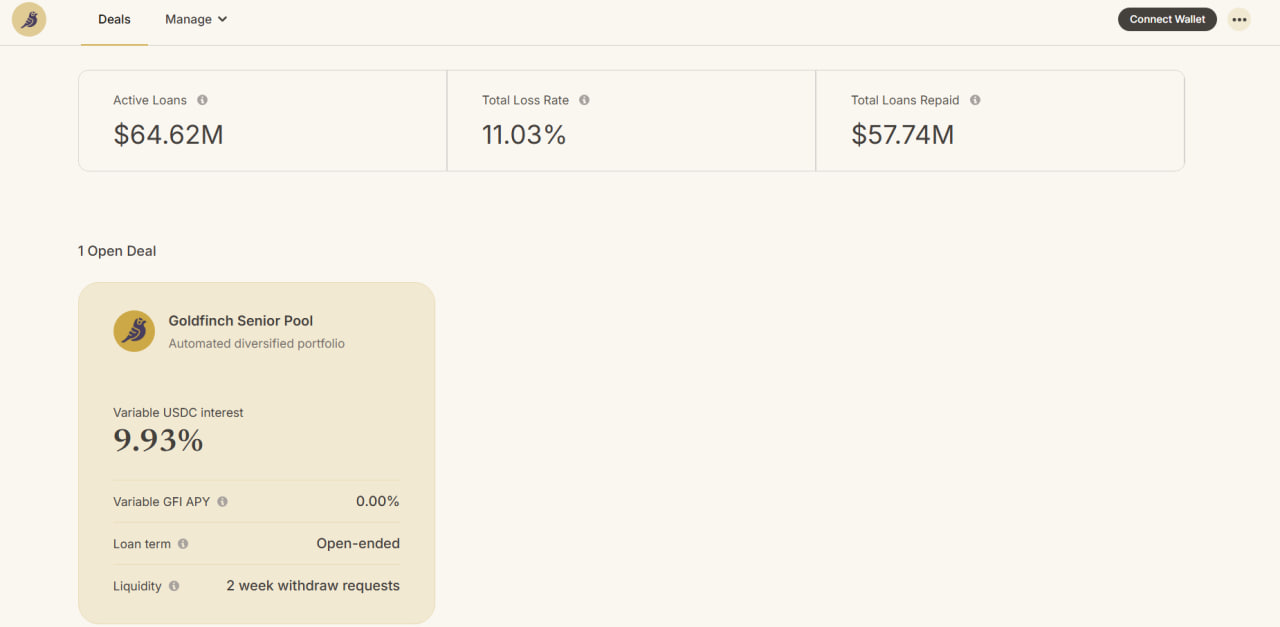

Goldfinch: Decentralizing No-Collateral Loans for Emerging Markets

Goldfinch is a DeFi peer-to-peer lending protocol designed to provide no-collateral loans, primarily targeting emerging markets. Unlike traditional DeFi protocols, which often require over-collateralization, Goldfinch allows businesses to access loans without needing to lock up more assets than they borrow. This design helps solve one of the main barriers to crypto adoption in the business sector—over-collateralization. By focusing on countries like India, Mexico, Nigeria, and Southeast Asia, Goldfinch expands access to capital for underserved markets, allowing over 200,000 borrowers to secure funding since its inception.

What makes Goldfinch unique is its removal of traditional gatekeepers like loan officers and banking personnel. Instead, the protocol uses smart contracts and a decentralized governance system to facilitate lending. By eliminating middlemen, Goldfinch provides faster, more transparent access to capital. Borrowers and lenders agree to loan terms through the protocol, allowing for instant funding without the delays and bureaucracy common in traditional financial systems. This efficiency opens up more opportunities for businesses that need quick access to capital.

The GFI token is at the heart of Goldfinch’s ecosystem. It serves as both the governance token and a reward for participants. Holders of GFI can stake their tokens to earn passive returns and participate in voting on protocol changes. The token also helps protect the protocol’s solvency, as staked GFI adds a layer of protection to borrower pools, reducing the risk of loan defaults.

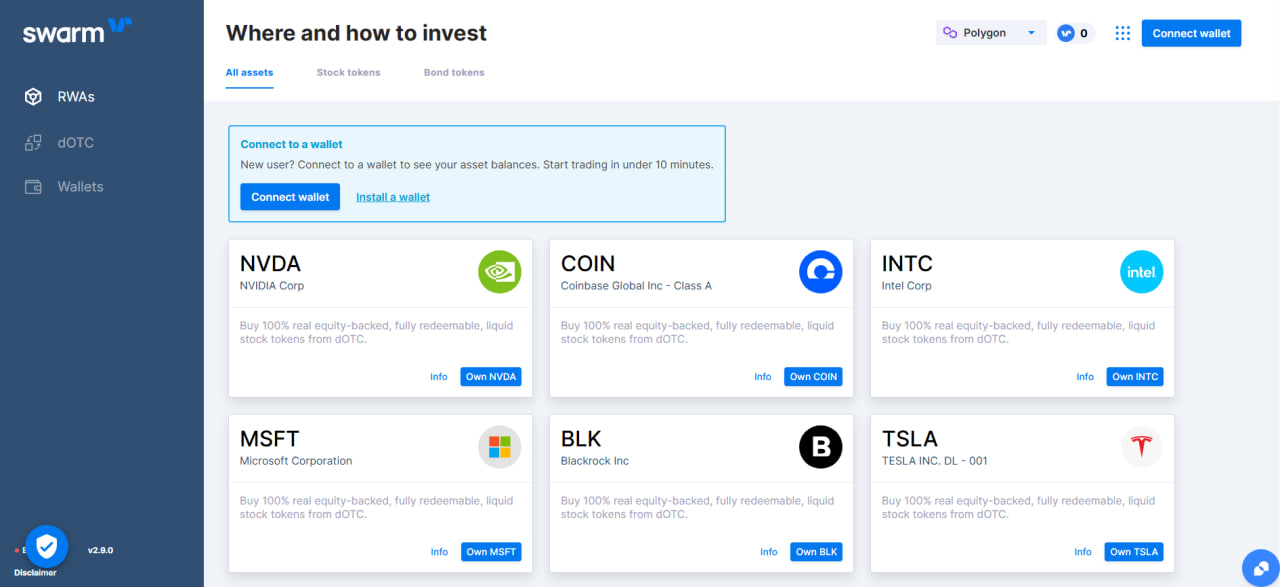

Swarm: Tokenizing Securities Under German Regulations

Swarm Markets is a licensed decentralized exchange (DEX) that enables the trading of tokenized versions of traditional stocks like Apple, Tesla, and Nvidia. Regulated by the German Federal Financial Supervisory Authority (BaFIN), Swarm is the first licensed DeFi platform offering a compliant environment for trading tokenized securities. Built on Ethereum, it uses an automated market maker (AMM) model, similar to Balancer, allowing liquidity providers to contribute tokens to pools, making these assets available for seamless trading.

Participation in Swarm requires users to complete a Know Your Customer (KYC) process known as Passport, which connects their identity to self-custodial wallets like MetaMask or Ledger. This ensures both retail and institutional investors can trade securely while adhering to regulatory standards. For larger transactions, Swarm offers a permissionless decentralized over-the-counter (dOTC) service, which allows institutions to execute trades with features like partial order fulfillment and private offers between wallets, giving them more flexibility in DeFi markets.

Swarm’s native token, SMT, plays a key role within the platform. Traders can use SMT to reduce their trading fees by up to 50%, while liquidity providers earn additional SMT rewards for contributing to liquidity pools. The platform also offers loyalty rewards, with users earning extra benefits based on the percentage of SMT held in their wallets, creating an incentive for long-term engagement and participation in the Swarm ecosystem.

Parcl: Tokenizing Real Estate Market Indices for Perpetual Trading

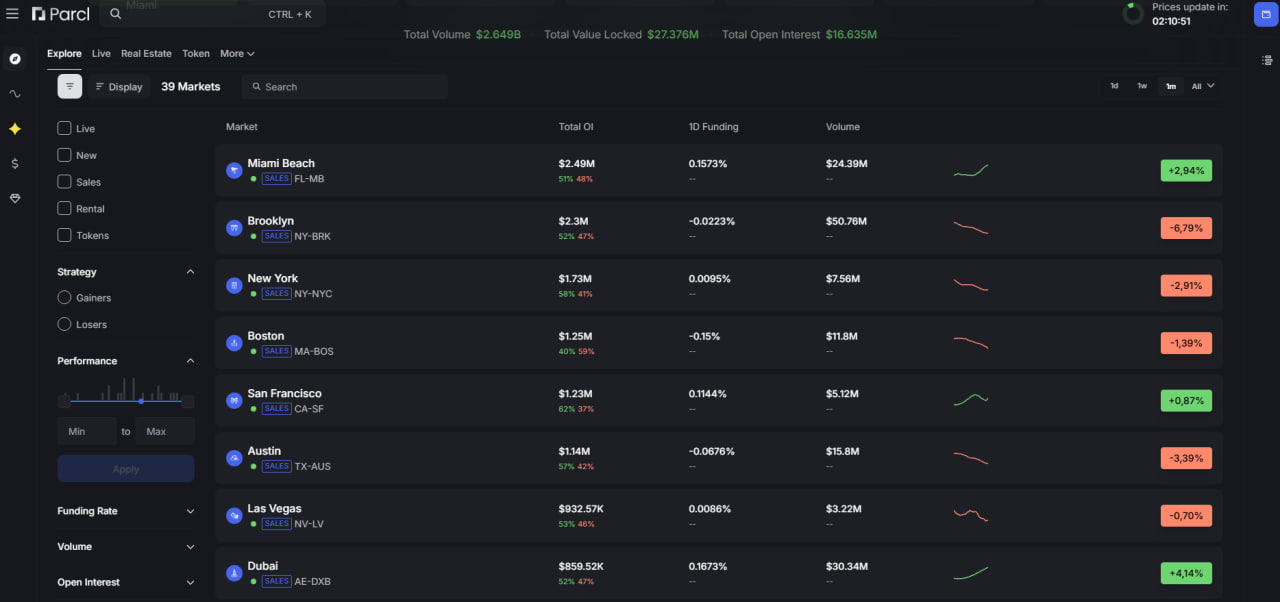

Parcl is a decentralized platform offering location-based real estate indices for perpetual trading. The platform operates on an automated market maker (AMM) model, enabling traders to open long or short positions on real estate indices derived from highly detailed market data. Parcl tracks property values across entire cities rather than individual properties, providing a broader view of market movements. To participate, traders use USDC stablecoin as collateral.

One of the standout features of Parcl is its Parcl Labs Price Feed (PLPF), which pulls data from various sources to create highly granular indices. The platform updates its indices daily, offering insight down to the price per square foot or meter for specific cities. Parcl tracks 26 regional indices, covering major U.S. cities like New York, Miami, and Los Angeles, as well as global locations such as Paris and London. This approach allows Parcl to provide some of the most accurate and real-time real estate data in the market, making it valuable for traders looking to capitalize on city-wide price movements.

Parcl’s native token, PRCL, serves multiple roles within the platform. As the governance token, it allows holders to participate in decision-making processes regarding platform updates and future developments. Additionally, PRCL provides access to institutional-grade real estate data via Parcl’s API, giving token holders an edge in analyzing market trends. In the future, PRCL will unlock further benefits through the Perpetual Points system, enhancing on-platform trading incentives and expanding its utility across the ecosystem.

Binaryx: Unlocking Fractional Ownership in Real Estate

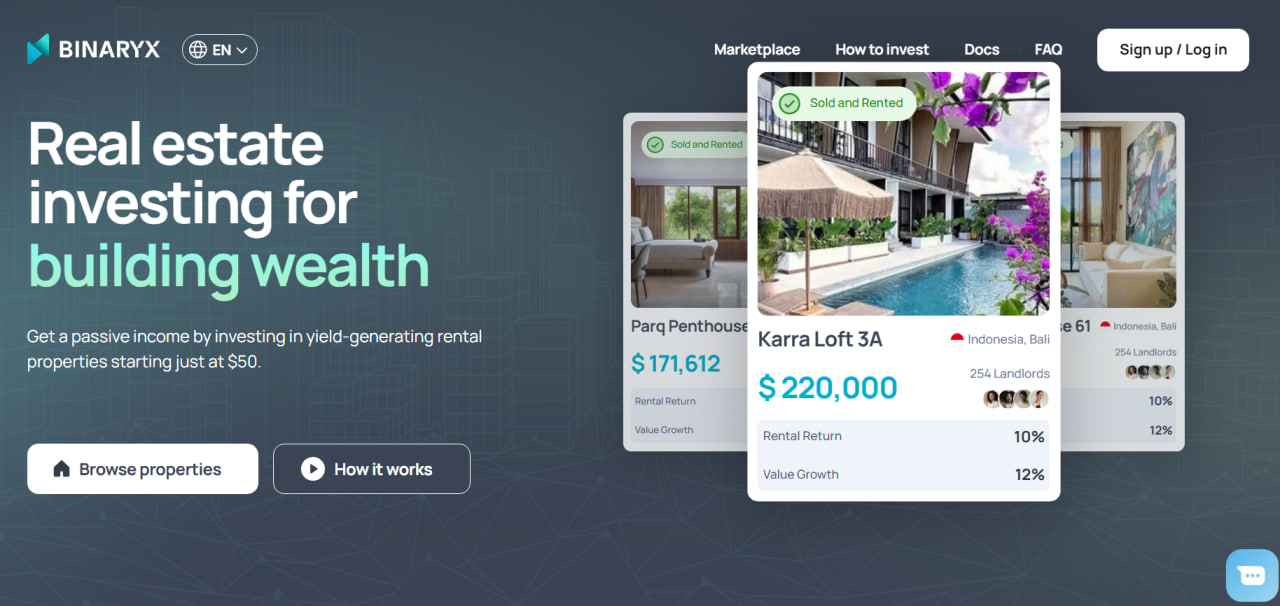

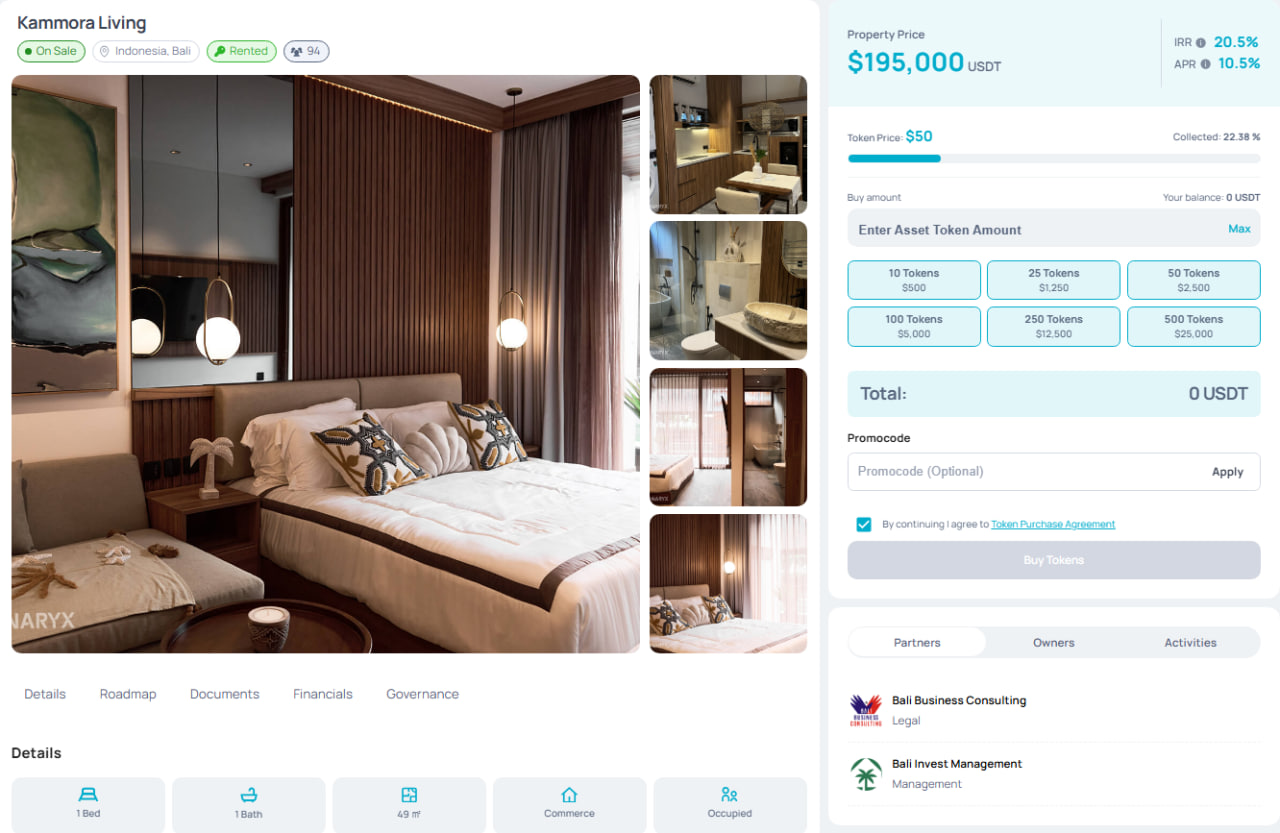

Binaryx is a real estate tokenization platform that introduces fractional ownership, allowing individuals to invest in properties with as little as $500. By dividing high-value real estate into digital tokens, Binaryx makes it easy for everyday investors to access property investments in sought-after locations like Bali, Montenegro, Turkey, and soon, Dubai. The platform securely connects investors with real estate operators, offering opportunities in both rental and construction investments, each with distinct features.

The property tokenization process is both simple and thorough. For example, when a $195,000 rental villa in Bali is tokenized, Binaryx establishes a special purpose vehicle (SPV) to hold the property’s title, typically as a limited liability company (LLC). This LLC issues digital tokens representing ownership shares, which investors can purchase. These tokens are backed by blockchain-based smart contracts that automate rental income distribution and track value appreciation. While rental investments generate steady income, construction investments focus solely on value appreciation as the project progresses.

Currently, Binaryx offers a range of property-specific tokens tied to individual assets. Investors can earn rental income from ready-to-rent properties or capitalize on price appreciation from early-stage construction projects. Looking ahead, a governance token is set to launch, providing even more opportunities for community involvement and driving the platform’s future growth.

Conclusion

Real World Asset (RWA) tokenization is evolving at a rapid pace, with a variety of innovative platforms opening up access to traditionally illiquid markets. Each project we've explored offers a unique approach—whether it’s Sky’s stablecoin ecosystem, Swarm’s securities tokenization, or Binaryx’s fractional real estate ownership. Together, they showcase the growing diversity and potential of the RWA space.

Whether you're interested in tokenized stocks, cutting-edge stablecoin models, or fractional real estate, these projects offer a glimpse into the future of finance. As the RWA ecosystem matures, these pioneering platforms are leading the way, creating new opportunities for both retail and institutional investors.

Articles you may be interested in

.jpg)

.png)

.png)

.webp)